Why capex is key to solving the supply chain issues hampering the economy

There are many incentives for capital expenditure (capex). Companies may invest in new technologies that help boost productivity and allow them to become more efficient. Or there may be inflationary pressures that companies want to offset with less waste, or through new equipment that will allow them to become more productive but will also help with the use of raw materials.

So, there is always an incentive for capex, but in recent years capex levels have not kept pace with depreciation, particularly from about 2017. There was also a significant deterioration in 2020, during the Covid-19 pandemic. As a result, a material underinvestment in capex has built up in recent years.

Some industries, such as coal and oil, have also consciously underinvested due to environmental, social and governance (ESG) pressures from investors.

Underinvestment is leading to supply shortages

We are seeing numerous examples of supply shortage; from steel to semiconductors, as well as haulage drivers in the UK and shipping containers in China.

Consequently, there is a huge tailwind of pressure to respond with supply side initiatives which we think basically boils down to capex.

On top of the need for higher spending by corporates, governments around the world are set to accelerate their spending after the Covid-19 crisis. The EU’s recovery package, which will begin to be spent in 2022, will be tilted towards green initiatives. This could be for new infrastructure to charge electric vehicles (EVs) or for the more efficient transmission of electricity and or super fast broadband. And then in the US we have President Biden’s infrastructure programme, which will be focused on spending on capital equipment covering renewables, airports and mass transportation.

Discover more at Schroders insights or try the links below:

– Podcast: a “code red for humanity” but a green light for investors

– Why investors should care about cybersecurity

– China: what zero tolerance, supply chain disruption and floods mean for economic growth

Perfect storm of inflation pressure and underinvestment

So, there is an underinvestment backdrop, combined with inflation pressure which is encouraging companies to invest to improve sooner rather than later. With a high backlog of orders and supply shortages, we currently have a perfect storm to encourage capex.

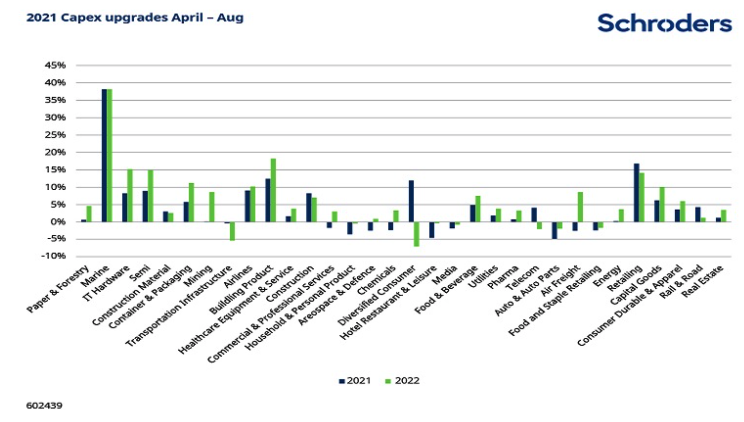

Our forecasts see capex growing by about 12% this year and then by 8% in 2022, which has only recently been upgraded by 5%. And this is a conservative estimate; we’ve already seen revisions to this figure and expect further upgrades. We are now about to hit peak capex, compared to levels seen in the past. However, if these figures are adjusted for inflation, we are still at much lower levels than we should be.

So, while capex is lower than it should be on an inflation-adjusted basis, it is also well below where it should be on a capex to depreciation basis (i.e. a company’s total capex versus the rate at which its fixed assets decline in value).

And then you’ve also got government spending programmes that are coming through.

What does this mean for investors?

This presents a two- to five-year opportunity for investors. To benefit from it, investors are likely to switch away from companies focused just on industrial production. Instead, they will move towards providers of capital equipment – covering robotics, process and discrete automation products, supporting software, energy efficiency products, providers of electrification and storage.

The likes of Siemens, Schneider and Daikin as well as Caterpillar or John Deere in the US could be among the beneficiaries.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.