Here’s why Britain shouldn’t worry about deflation just yet

Plumper pay-packets, and falling prices, are making people much better off. But they're just still not spending. This is curbing sales, squeezing businesses' earnings, and leading to wage cuts and layoffs. This is what a dreaded deflationary spiral looks like. Luckily, it's not something we have to worry about just yet.

Official figures which are due to be released tomorrow will show the rate of inflation has dropped to almost zero, and it's expected to turn negative in the coming months, according to official estimates from the Bank of England.

Mark Carney, governor of the Bank of England, has repeatedly stressed the bout of low prices will be short-lived. While tumbling global oil prices are largely to blame for low prices, this is something that will eventually subside.

But in the meantime, the recovery in wages will start to boost domestic demand, and in turn drive up prices.

There are two sides to every story, and when it comes to deflation, Britain is likely experiencing the rosier one. So-called "benign deflation" is primarily due to technological progress as well as productivity improvements. These flood markets with products, and as the surplus drives down prices, people reap the benefits of low prices while shielding them from the nastier side-effects such as falling wages, layoffs etc.

This makes it markedly different from its more sinister sounding counterpart, known as "malevolent deflation".

Threadneedle Street's most recent quarterly survey showed inflation expectations had fallen to a 13-year low, slumping to just 1.9 per cent, which was down from 2.5 per cent in November.

Nonetheless Howard Archer, Chief UK & European Economist IHS Global Insight, said that they were not "hugely weak and there is crucially no evidence that deflation … is considered a possibility."

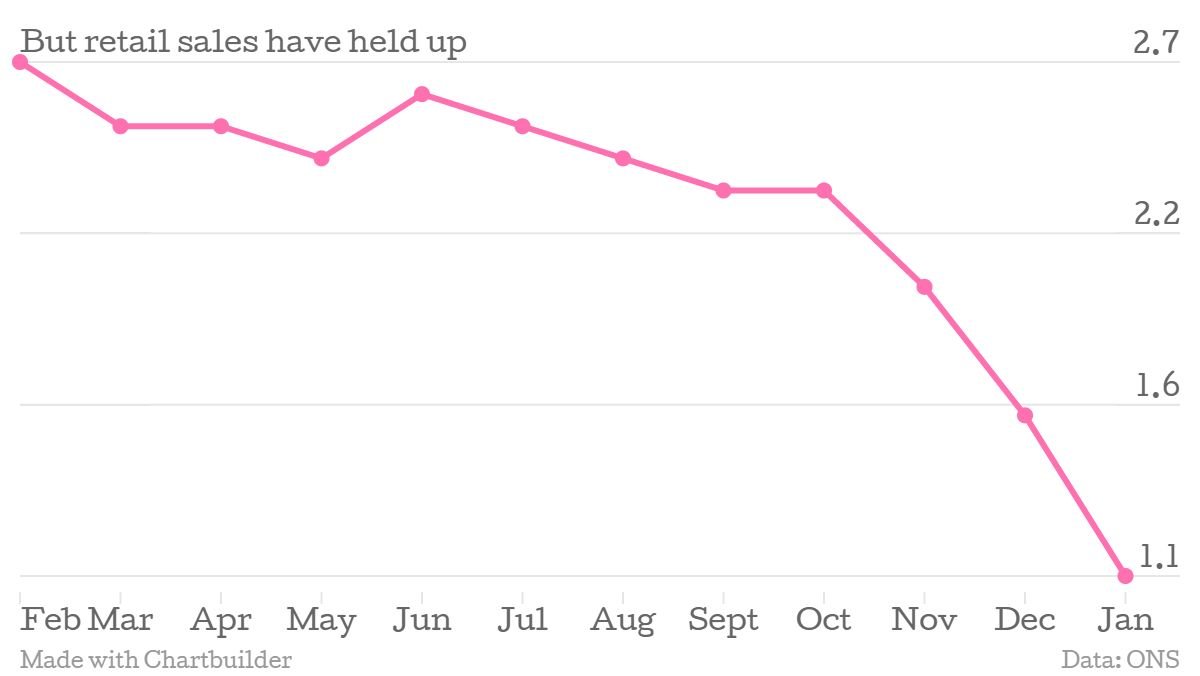

Meanwhile, retail sales continue to grow, and figures due out this week are expected to show they grew 0.3 per cent month-on-month in February.

"[They] dipped 0.3% month-on-month in January, but this was actually a relatively resilient performance after sales volumes had previously jumped 2.2% quarter-on-quarter in the fourth quarter of 2014."