Who will build the roads (after these capacity constraints)?

Since the New Year, a number of surveys have been pretty explicit about new constraints on the supply of materials and labour in specific industries.

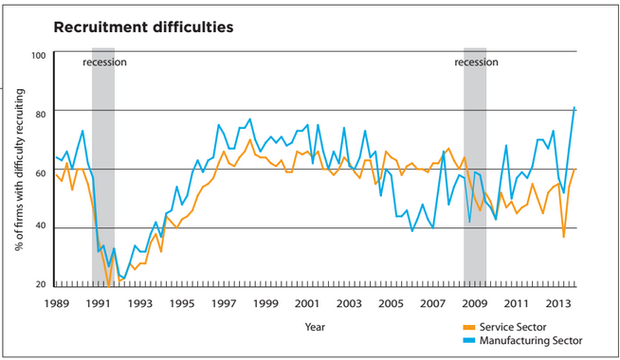

Last week, the British Chambers of Commerce said that 81 per cent of manufacturers are reporting difficulties in recruitment, the highest on record. In Services, it’s 60 per cent, perhaps more appropriately back at a level last seen in 2008.

The Recruitment & Employment Confederation/KPMG survey later last week also reported the steepest reduction in staff availability for permanent roles in nearly a decade.

Maybe most worryingly, the hollowed-out construction industry is also reporting considerable capacity issues to the Royal Institution of Charter Surveyors: shortages of labour and materials have leapfrogged low demand in firms’ most cited constraints.

There are a few questions that the surveys raise: first and foremost, are they accurate? Some surveys have seen a bit of an overestimation of the upturn during the second half of last year (for example, in the difference between November’s roaring Manufacturing PMI and the relatively modest official figures).

Even if the difficulty in finding appropriate skills is being overestimated, it is still a point of interest and concern. With unemployment still elevated from normal pre-recession levels, has the UK’s labour force been permanently weakened by the crisis? And if it really is so difficult to find workers, shouldn’t we finally see an increase in real wages in the year ahead?