A whale of a fine for JP Morgan

JP MORGAN was yesterday hit with a giant-sized £570m fine for failures leading to the London Whale scandal, where bosses did not notice a derivatives trader building huge positions that eventually lost the bank $6.2bn (£3.9bn).

Initially traders tried to hide the problems from their supervisors, beginning in 2007. But watchdogs say by 2012 executives were failing to take inconsistencies in the numbers seriously, and so were also partly to blame for the scale of the scandal.

Britain’s Financial Conduct Authority (FCA) is fining the bank £137.6m, while the US Securities and Exchange Commission is charging JP Morgan $200m, the Federal Reserve is taking another $200m and the Office of the Comptroller of the Currency has levied another $300m.

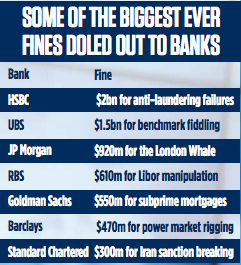

The total fine of $920m is more than the $750m previously expected, and is one of the biggest regulatory penalties a bank has ever faced.

The pain is not over yet for JP Morgan. Another US regulator, the Commodity Futures Trading Commission (CFTC), still has to decide by how much it is going to punish the investment bank.

“When the scale of the problems at JP Morgan became apparent, it sent a shock-wave through the markets. We consider JP Morgan’s failings to be extremely serious such as to undermine the trust and confidence in UK financial markets,” said FCA enforcement director Tracey McDermott yesterday.

“There were basic failings in the operation of fundamental controls over a high risk part of the business. Senior management failed to respond properly to warning signals that there were problems in the chief investment office.”

She added that the firm was slow to recognise the size of the problems, and made it worse by “failing to be open and co-operative with us as their regulator”.

The bank accepted blame for the scandal as part of the terms of the settlement, and promised to stop such a crisis arising again.

“We have accepted responsibility and acknowledged our mistakes from the start, and we have learned from them and worked to fix them,” said JP Morgan chairman and chief executive Jamie Dimon.

“Since these losses occurred, we have made numerous changes that have made us a stronger, smarter, better company.”

But industry watchers warned the scale of the problem shows the bank needs to make more fundamental changes than spending more on compliance and supervision.

“This affair was not due to bad individuals, it was due to a bad system – simply investing in more systems and risk officers is unlikely to be enough,” said Professor Andre Spicer from Cass Business School.

“The bank needs to develop a culture which is more concerned with prudence than excessive risk taking. It is also vital that when staff see something going wrong they have the space to speak out.”

JP Morgan’s shares ended the day down 1.24 per cent.