Wage growth slows faster than expected and unemployment picks up slightly

Wage growth came in slightly below expectations, new figures show, as evidence builds that the Bank of England’s interest rate hikes are creeping through into the wider economy.

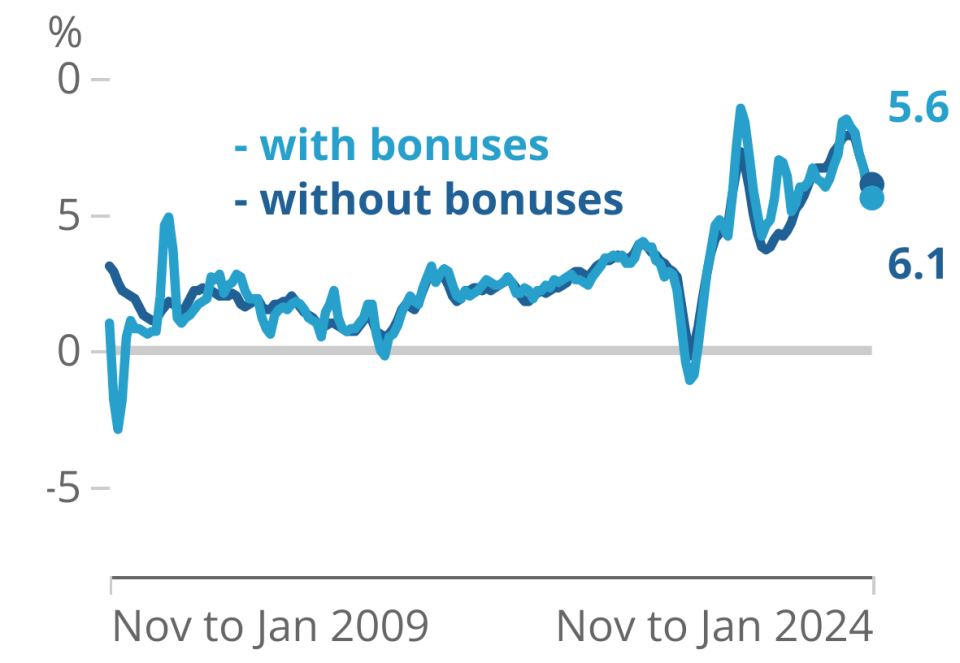

Annual pay growth including bonuses averaged 5.6 per cent between November and January, according to figures from the Office for National Statistics (ONS). Economists had expected it to remain more or less stable at 5.8 per cent.

Excluding bonuses, the figure was 6.1 per cent compared to 6.2 per cent previously.

Although wages are now growing more slowly than before, lower inflation means households are actually still seeing a boost to their real pay. Real total pay rose 1.4 per cent between November and January.

“Recent trends in the jobs market are continuing with earnings, in cash terms, growing more slowly than recently but, thanks to lower inflation, real terms pay continues to increase.,” ONS director of economic statistics Liz McKeown said.

There were other signs that the labour market, which has so far been remarkably resilient to the Bank’s rate hikes, might be loosening.

Unemployment crept up to 3.9 per cent from 3.8 per cent, above market expectations. The number of vacancies, a measure of labour demand, fell by 43,000.

This means that vacancies have been falling for 20 consecutive quarters, although there are still around 100,000 more vacancies than pre-pandemic.

“Today’s ONS figures paint a familiar picture of further gradual softening in the labour market and easing pay pressures, but it remains an incremental process,” Jack Kennedy, senior economist at Indeed commented.

The figures come as the Bank of England deliberates on when to start lowering interest rates, which currently stand at a post-financial crisis high of 5.25 per cent.

Rate-setters are paying careful attention to developments in the labour market for signs that higher interest rates are working to slow the economy, thereby bringing down inflation.

The Bank’s most recent Monetary Policy Report suggested that there needed to be a “moderation in pay pressures” to bring down services inflation, a key gauge of domestic inflationary pressures.

But economists argued that Tuesday’s figures would do little to change the Bank’s current thinking.

Yael Selfin, chief economist at KPMG UK said the data was “unlikely to warrant a major policy shift” from the Bank as pay growth remains “robust”.

Paul Dales, chief UK economist at Capital Economics, agreed. “The easing in wage growth in January is probably still a bit too slow for the Bank of England’s liking,” he said.

While the figures show that the labour market remains tight, survey data suggests cracks are starting to show.

Starting salary inflation dropped to its lowest level in nearly three years, according to the KPMG-REC jobs survey. The survey also showed that there had been an “accelerated reduction” in demand for workers alongside a “marked upturn” in candidate supply.

Selfin thought that pressure would continue building on the labour market, allowing the Bank to pivot to rate cuts. “We expect the labour market to weaken in the coming months, which should reduce momentum in wage growth and raise the prospect of interest rate cuts from the summer onwards,” she said.