Vodafone announces surprise £1bn buyback

Mobile telecoms giant Vodafone moved to defend its share price yesterday and stunned the city by announcing a surprise £1bn share buyback programme, after its stock plummeted on the back of a weak trading update.

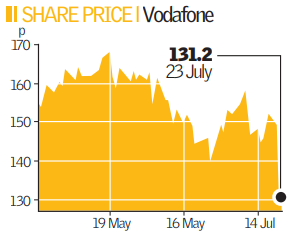

Shares in the firm slumped by almost 14 per cent on Tuesday, wiping nearly £11bn off its market value, after the group said its full-year revenue would be near the bottom of its forecast range. The news unsettled investors, who had hoped that the telecoms sector would remain resilient in the face of an impending recession.

Following yesterday’s buyback announcement, Vodafone’s stock was up by nearly 2 per cent at 131.4p, giving the firm a market cap of £70bn.

“The board of Vodafone has considered the market reaction and has decided to introduce a £1bn share repurchase programme with immediate effect. The action reflects the board’s belief that the share price significantly undervalues Vodafone,” the firm said.

Vodafone said the buyback would need shareholder approval at its annual general meeting at the end of July. It will pay up to 105 per cent of the share’s average closing price on the five business days before the buyback.

But many analysts were unmoved by the announcement, regarding it as a gesture of belief that was unlikely to make the stock recover.

“This amounts to around 1.4 percent of Vodafone’s outstanding share capital. As such, the financial implications are not material with sentiment, and management’s confidence is the more important issue to consider,” said Cazenove analysts.

Tom Gidley-Kitchin, an analyst at Charles Stanley, said that Vodafone was still a good buy, especially at its current price. “In our opinion, the share is cheap and the current price takes it back to its 2006 value, when it was only beginning to expand,” he said.