Verizon talks boost Vodafone to 12-year high

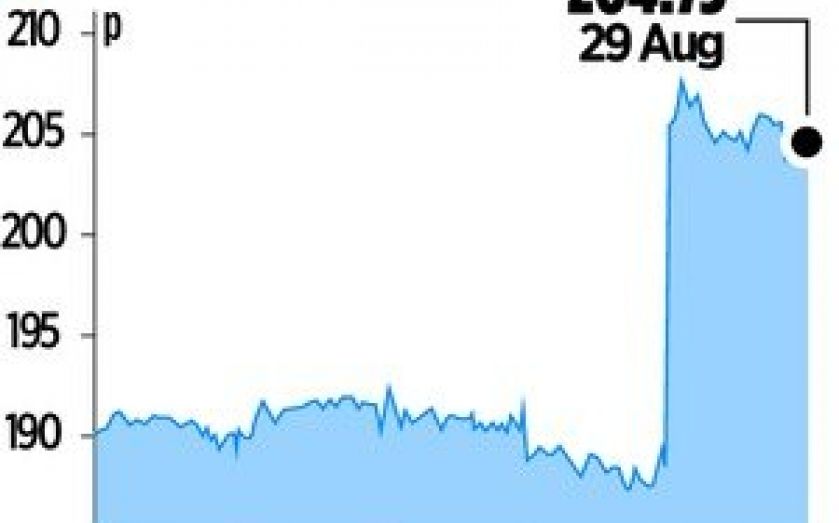

TELECOMS giant Vodafone saw shares jump to a 12- year high yesterday as it confirmed it is in talks to sell its stake in Verizon Wireless back to the US mobile operator.

The deal could see Verizon offer Vodafone in excess of $100bn (£64bn) for the 45 per cent stake that it holds in the joint US venture.

Trading volumes – the average amount of individual securities traded in a day – hit a high of over £400m, four times the group’s typical daily trade volume of £90m. The confirmation of talks, the first time Vodafone has publicly acknowledged the chance of a deal despite years of speculation, boosted Vodafone’s value by more than £10bn.

Deutsche Bank analyst David Wright said yesterday that Vodafone’s renewed interest in a deal stems from, “increasing competition from T-Mobile US, Sprint and… fears of a narrowing window for low interest rate refinance at Verizon also play a key role.”

Investors will be expecting a hefty payout with the proceeds from any possible deal, with the prospect of large shareholder returns on the table once the firm has covered tax payments and paid off some of its debts.

Bankers advising on the deal are also in for a windfall, with estimates that total fees could run as high as $250m.

But analysts at Olivetree Financial Group poured cold water on the chances of success, claiming that the market is only pricing in a 40 per cent chance of a deal being announced.