Brits face mortgage crisis as number in arrears climbs to highest this decade

The value of UK mortgages in arrears climbed to its highest level since 2016, as rising interest rates pour pressure on borrowers.

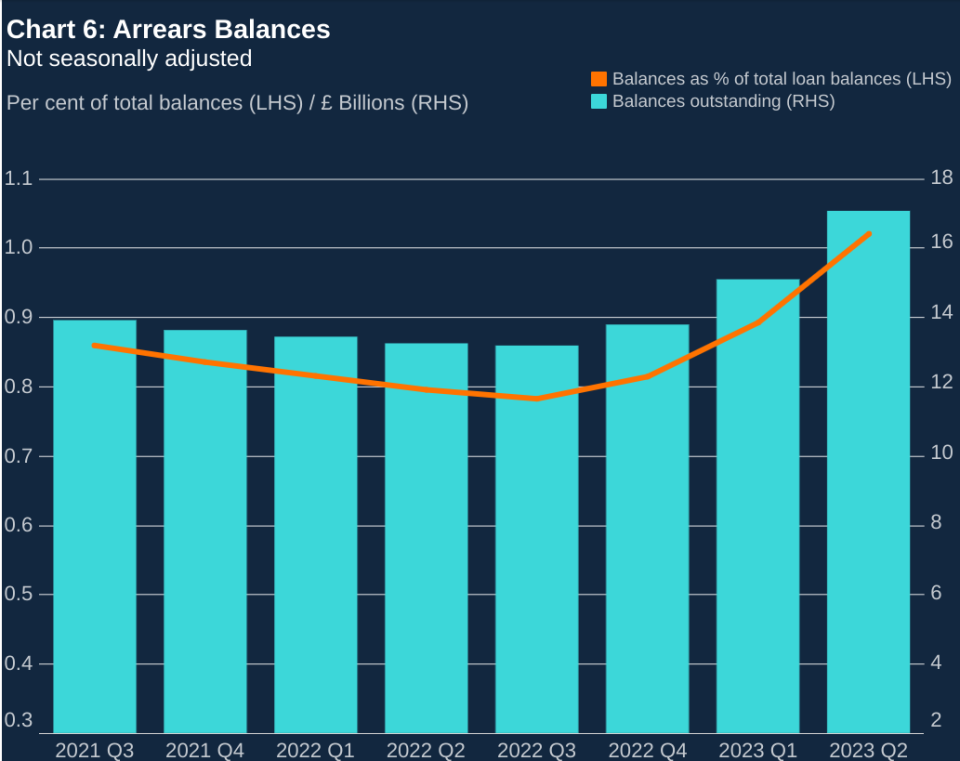

According to Bank of England data, the total value of residential mortgages in arrears of at least 1.5 per cent of the outstanding mortgage increased by 13 per cent on the previous quarter to £16.9bn.

This was the highest seen since the third quarter of 2016 and 28.8 per cent greater than a year earlier.

New arrears cases accounted for 16 per cent of total outstanding balances, which was roughly constant to the previous quarter.

The proportion of loan balances with arrears increased to 1.02 per cent, up from 0.89 per cent, the highest level since the first quarter of 2018.

Rising interest rates have heaped pain onto borrowers, many of whom are having to refinance fixed-rate deals agreed when interest rates were near zero.

By the end of 2026, the Bank of England estimates that around 1m families will be paying at least an additional £500 a month to service their mortgage, amounting to a £6,000 annual increase.

The Bank of England’s data reinforces the view that the level of arrears is starting to pick up, albeit from very low levels.

Recent figures from industry body UK Finance, showed there were 81,900 homeowner mortgages in arrears of more than 2.5 per cent in the second quarter, seven per cent more than the previous quarter.

Despite the impact of rising rates, the value of new mortgage commitments was 26 per cent greater than the quarter before at £61.7bn, the first increase since the third quarter of last year.

The data also showed that the total outstanding value of mortgage loans fell at the fastest pace on record. The total value of outstanding residential loans in the second quarter was £1.66 trillion, compared to £1.68 trillion the quarter before.