US stocks resist following FTSE lower as markets digest Fed minutes and oil rout

Wall Street resisted the European market rout that sent the FTSE falling today and opened broadly flat today as investors digested news that the US Federal Reserve may tighten monetary policy this year.

The S&P 500 edged down to 4,399.90 points, while the Dow Jones slipped to 34,944.70 points.

Concerns about a possible earlier than expected end to the Federal Reserve’s ultra-loose monetary policy measurs unleashed in response to the Covid crisis are mounting.

Yesterday, the Fed released minutes breaking down details from its latest Federal Open Market Committee meeting in July. The report highlighted that most Fed ratesetters would be open to tapering its bond buying programme this year.

The tech-heavy Nasdaq dropped 0.12 per cent to 14,508.84 points.

Yields on 10-year Treasuries crept up to 1.25 per cent

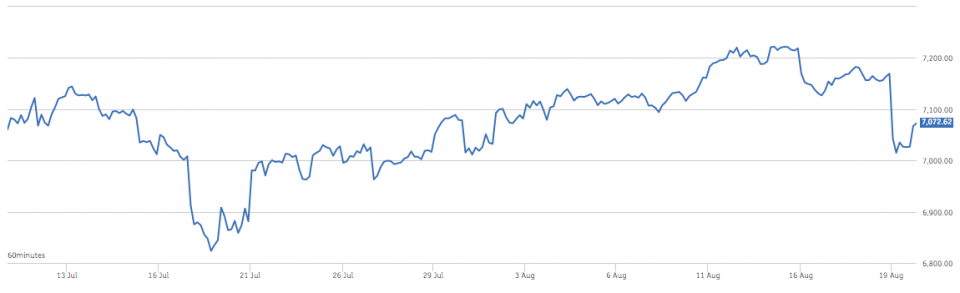

Collapsing oil prices send FTSE 100 plummeting

A collapse in oil prices today sent shares in industrials and mining companies plummeting, dragging London’s FTSE 100.

The capital’s premier index slid 1.36 per cent to 7,068.72 points in the afternoon trading. The FTSE has now lost most of gains made during August.

International benchmarks WTI and Brent Crude plunged this morning by 2.8 per cent and 2.36 per cent respectively. Prices hit a three-month low.

Lower oil prices weighed heavily on shares in blue-chip giants BP and Anglo American, down 4.38 per cent and 10.03 per cent respectively.

Russ Mould, investment director at AJ Bell, said: “The FTSE 100 took a bath on Thursday morning, dragged lower by weakness in the resources sector amid fears the US Federal Reserve might be about to pull the rug from under the market by tapering its support for the economy early,”

A tightening of monetary support from the Fed could slow the global economic rebound from the pandemic, which would be likely to trigger demand for oil to tumble.

Meanwhile, the mid-cap FTSE 250 lurched deep into the red, dipping 0.71 per cent to 23,666.74 points. AIM shares did not fare much better, falling 0.50 per cent to 1,260.05 points.

“The question now is whether a volatile week is the prelude to the kind of late summer sell-off we have seen in previous years or if the market can regain its poise moving into the autumn,” Mould added.

The pound lost ground on the greenback, falling 0.48 per cent to $1.3690.

Winners and losers

Miner Polymetal International led the biggest risers on the FTSE during afternoon trading, up 1.64 per cent to 1,515.50p, while takeaway delivery service company Just Eat Takeaway.com jumped 1.11 per cent to 6,714p.

Miner Anglo American suffered severe a hit to its share price in morning trading, tumbling to 2,907.50p. Mould suggested the sharp drop could be the result of the “fact they are trading without the rights to a very generous dividend payment.”

Luxury fashion retailer Burberry was the second worst performer on the blue-chip index, dropping 6.11 per cent to 1,822.50p.

Financial services firm Phoenix Holdings absorbed a 6.11 per cent blow, sending its share price down to 635.20p.

Around the world

London’s abysmal performance was reflected in Asia in overnight trading as sentiment soured on concerns that mounting new Covid cases driven by the Delta varient could hamper the region’s economic prospects.

Japan’s Nikkei plunged 1.1 per cent to 27,281.17 points and Hong Kong’s Hang Seng tumbled 2.13 per cent to 25,316.33 points.

China’s CSI 300 lost 0.66 per cent to fall to 4,862.14 ponits.

European shares suffered a similar fate – the Stoxx 600 was down 1.51 per cent to crash to 467.24 points.