US in teeth of ‘deep recession’ in ominous sign for rest of world

The US is in the teeth of a “deep recession” in an ominous sign for the world’s other largest economies, experts warned after a closely watched survey came in much weaker than expected on Wall Street.

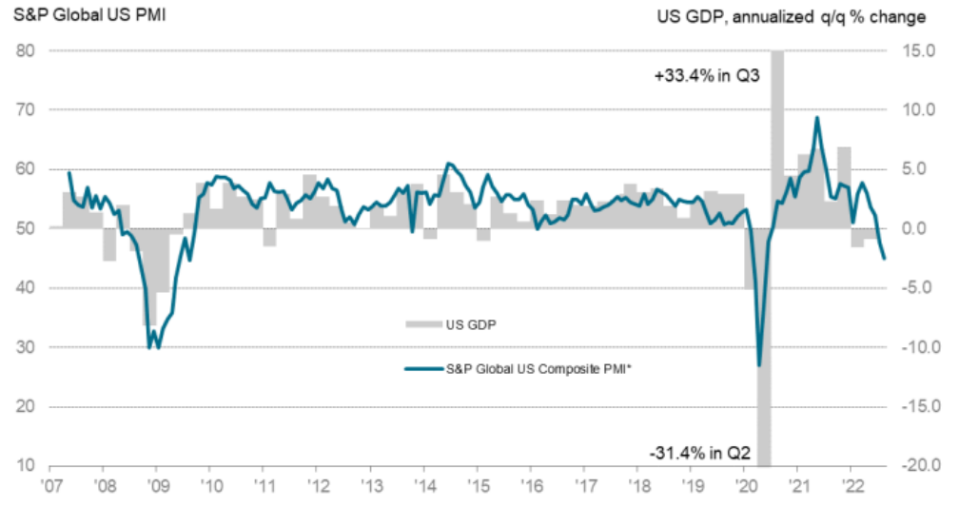

S&P Global composite purchasing managers’ index (PMI) dropped to 45 points this month, the lowest in over two years and down from July’s 47.7 reading.

A reading below 50 points means a majority of firms reported shrinking activity.

US economic activity has sunk two months in a row

The world’s largest economy is being hit by a series of rate rises by the Federal Reserve as it steps up its fight against the biggest inflation surge in generations.

That rapid tightening has prompted economists to reason the Fed is happy to engineer a recession to shake inflation out of the country.

Fed chief Jerome Powell and the rest of the federal open market committee have raised borrowing costs 225 basis points since March, the fastest tightening cycle since the early 1980s from former chairman Paul Volcker led the charge against another inflation spike.

Soaring prices have eroded consumers’ spending power, while ongoing supply chain disruption has cooled business activity.

Paul Ashworth, chief North America economist at Capital Economics, said the soft PMI is “consistent with a deep recession,” adding “based on the historical relationship, it suggests GDP should be contracting at a three per cent annualised pace”.

“Gathering clouds spread across the private sector,” Siân Jones, senior economist at S&P Global Market Intelligence, said.

“Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity,” she added.

Inflation dropped much quicker than expected to 8.5 per cent last month, down from a 40-year high of 9.1 per cent, igniting hope among economists that price pressures are easing across the pond.

Analysts are fretting that Powell at his speech on Friday at the annual central banking symposium at Jackson Hole, Wyoming will roll back on Wall Street’s hopes of a slowdown in rate rises.

The Fed is still expected to keep hiking rates to prevent so-called second-round inflation effects taking hold of the world’s biggest economy.

Central banks rarely raise borrowing costs during a recession to avoid heaping more pressure on businesses and households.