US debt problem may be solved sooner than expected

America's debt problem may be solved sooner than many think, according to new research from Capital Economics. Their analysis suggest that in the short term, rising GDP growth and a limited rise in interest rates will contain American debt.

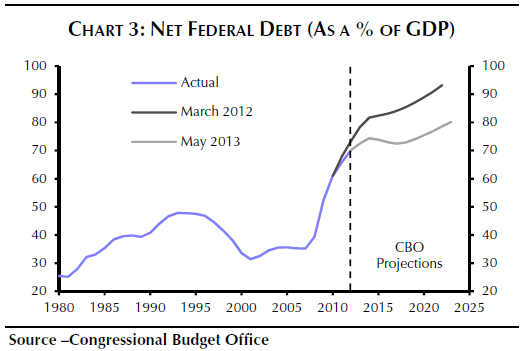

The sharp fall in the size of the deficit means that America is no longer expected to reach a debt ratio of 100 per cent of GDP. The current ratio of debt to GDP of 73 per cent is double what it was before the recession but high demand for US debt does not make this a worrying figure.

That's largely down to an expected long-term fall in healthcare inflation. That will see spending on healthcare rise more slowly than had been anticipated. Despite these positive developments the London-based consultancy does not expect debt to start falling in this decade, with debt stabilising at around 80 per cent of GDP.

The group point to history of the US in bringing down large deficits as cause for optimism. A growing consensus for such measures as linking social security to a lower rate of inflation is reason to believe that temporary Washington gridlock will not disable the country's ability to deal with its debts.

Capital Economics does warn that the consequences of the rapid expansion of the Federal Reserve's balance sheet are still unknown. If inflation is unleashed then the debt ratio is likely to fall. The group stress that this would be a more effective strategy if accompanied by financial repression that keeps Treasury yields artificially low.

Senior US economist, Paul Dales writes:

Overall, a combination of austerity, financial repression and perhaps inflation may be needed to solve the debt problem once and for all. We suspect this may happen sooner than anyone expects.