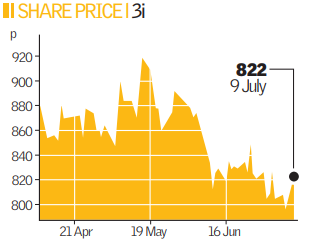

Upbeat 3i soothes investors’ nerves

Publicly listed private equity company 3i yesterday soothed investors with an upbeat trading statement, reassuring them that it was still well placed for investment opportunities despite the credit crunch.

Chief executive Philip Yea said the mid-market – 3i’s key market – had remained open over the first three months of the year, providing both investment opportunities and continued realisations despite the “challenging economic outlook”.

“We remain highly selective with respect to new investment, and continue to monitor closely the financial performance of our portfolio,” he said. “This approach, combined with the diversity of our business in terms of asset class, geography and sector put us in a good position to deal with what continues to be an uncertain economic environment.”

That uncertain environment caused the amount 3i spent on new investment in the past quarter to drop by almost a third. 3i invested £428m, compared with £591m last year.

The amount the firm made from asset sales dropped by 50 per cent to £301m, however the figure excluded about £240m from the sale of Belgian freight carrier ABX Logistics Worldwide in June.

The trading statement was welcomed by analysts. JPMorgan Cazenove, which has an “outperform” recommendation on the stock, said there no surprises and there was no reason to change their numbers.