Unemployment jumps unexpectedly to 7.2pc

Looks like unemployment falls have hit a speed bump.

Unemployment in the three months to December has seen a surprise increase, rising to 7.2 per cent.

That's the first increase in UK unemployment since January 2013.

Last month saw the jobless rate fall to 7.1 per cent, and consensus estimates had suggested that the rate would stay flat.

Single month figures show that 2.36m were unemployed in December, up from 2.28m in October.

The latest Office for National Statistics data shows that average earnings have only seen annual growth of 1.1 per cent. That's still well below inflation, which as measured by the consumer price index is still running at 1.9 per cent.

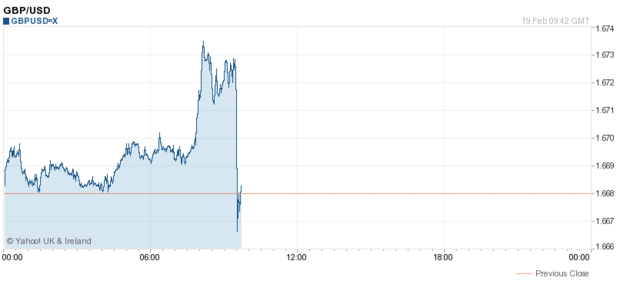

The pound has taken a beating against the dollar on the news.

Source: Yahoo! Finance

Some measures showed improvement.

Howard Archer, chief UK and European economist at IHS Global Insight, points to early signs "that productivity is finally starting to pick up".

Bank of England warns long term rates may be lower

After keeping policy unchanged in February the Bank of England's monetary policy committee minutes are also out.

At that meeting members of the MPC would have known that unemployment had fallen to 7.1 per cent – 0.1 percentage points above the level at which the Bank has indicated that it will consider a rate hike.

The MPC was unanimous in voting for no change in policy.

Comments from the MPC were more interesting, stating that appropriate long term interest rates may now "materially below" their pre-crisis average of five per cent.

But there was no vote on any new phase of forward guidance.

Jeremy Cook, chief economist at foreign exchange company World First, says that the "the Bank of England will be keen to emphasise that any further improvements will materialise more slowly than they have in recent months, the closer we get to the long run average of 6.5 per cent."

"We should all still expect to see rate hikes beginning in the second quarter of 2015 and no sooner," says Cook.