UK TV box firm Pace pays £191m for Aurora in US

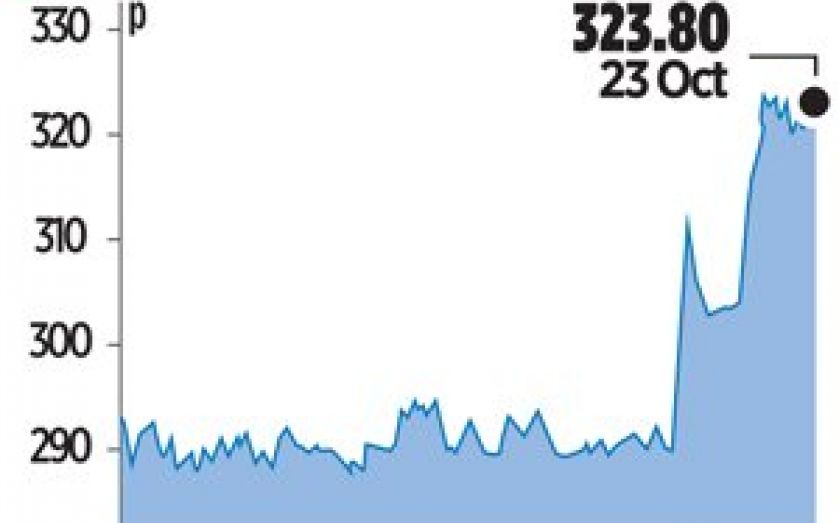

SET-TOP box maker Pace yesterday saw its share price skyrocket more than ten per cent to value the company at over £1bn, after the company announced it would buy US network firm Aurora Networks for $310m (£191.7m).

Pace expects the purchase will significantly boost the company’s earnings in 2014, with cost savings from synergies worth $8m. Aurora makes broadband equipment to help fibre operators cope with increasing data loads being used by homes.

“Acquiring Aurora will allow Pace to expand beyond our core business and build deeper and more embedded relationships with our customers, which the company believes will strengthen Pace’s position as a market leading solutions provider for the PayTV and broadband industries,” said Pace chief executive Allan Leighton.

The Aurora deal was financed with a five year $310m loan from HSBC and RBS and JP Morgan Cazenove acted as Pace’s financial adviser on the deal, which is expected to close by the end of the year.

Jefferies analyst Lee Simpson said that the existing cash conversion at Pace, together with synergies from this deal, should pay off within two years.

“Pace targeted this opportunity without impairing the existing capital structure – no rights issue was used, so no investors were diluted. The simple addition of profits sees the new group with around $240m EBITA on (revenue of) about $2.6bn pre-synergies.”

Shares closed at an 11 year high of 323.8p yesterday.

ADVISERS

HUGO BARING

JP MORGAN CAZENOVE

JP Morgan Cazenove acted as sole financial adviser, sponsor and corporate broker to Pace in its purchase of Aurora.

Hugo Baring led the team from JP Morgan Cazenove and has a long history of advising on large technology deals.

A member of the Baring family banking dynasty, Hugo Baring joined JP Morgan Cazenove from Morgan Stanley in 2007 as a managing director in the technology, media and telecoms group.

At Morgan Stanley, Baring advised BSkyB on its controversial acquisition of an 18 per cent blocking stage in rival ITV, and Reuters on its $17.2bn sale to Thomson in 2007.

On joining JP Morgan Cazenove, Baring advised market research firm Taylor Nelson Sofres, helping it to negotiate a price before agreeing to sell to WPP in 2008.

More recently he advised Hellman & Friedman on its £1.1bn acquisition of Wood Mackenzie and Cinven on its £1bn purchase of CPA in 2013.

The financing facilities for the deal are being provided by HSBC and RBS as joint underwriters, bookrunners and mandated lead arrangers with JP Morgan Chase Bank as lead arranger.