UK retail funds bloom as green shoots emerge

SAVERS took heart from the UK’s early signs of recovery last month to drive retail fund sales to their highest level in over two years, figures out yesterday show.

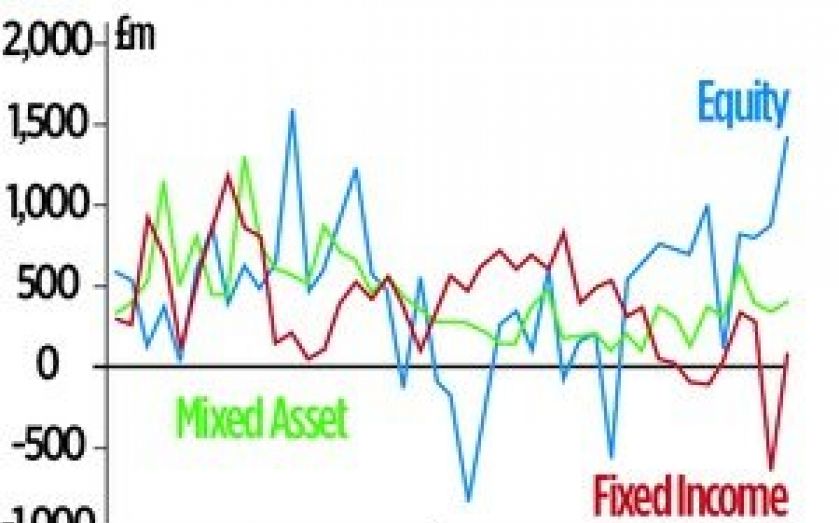

Investors saving for retirement poured an extra £2.2bn into retail funds in July, the highest level since April 2011, with equity market funds leading the charge.

The surge is a remarkable turnaround for markets after a short-lived blip in June when equity fund sales fell to £1.1bn following hints the US could roll back its supply of cheap market money.

“We saw investor confidence returning strongly in July… There has been significant change in outlook in the domestic economy,” Hargreaves Lansdown senior investment management Adrian Lowcock said.

US equity funds, which commonly own stocks exposed to the US economy, were the most fashionable funds last month, adding about £250m in July versus a normal average of about £30m.

Bond funds, which were shaken badly by Bernanke’s comments, bounced back slightly in July ticking up into positive territory.

Retail funds are traditionally sold to people through defined contribution pension schemes.