UK poised to have officially dodged recession last year as outlook brightens

Britain is poised to have officially swerved a recession last year, the country’s statistics agency is expected to confirm this week.

New final numbers outlining economic growth in the final three months of 2022 are likely to hold steady at zero per cent, meaning the UK narrowly dodged the official recession definition of two consecutive quarters of contraction.

The economy slipped 0.2 per cent in the three months to September, while monthly GDP for December was deeply negative at minus 0.5 per cent.

“Having confounded the doomsters, this week’s final Q4 GDP numbers are expected to show that the UK economy avoided a technical recession,” Michael Hewson, chief market analyst at CMC Markets, said.

Experts have also ditched their recession projections for this year, mainly due to households holding up better amid the worst cost of living crunch in a generation.

Last week the Bank of England said it now reckons the country will avoid a long economic slump. In November it warned of the longest recession in a century.

Investors this week will also be closely watching new inflation numbers for the eurozone for signs of whether the European Central Bank’s series of outsized 50 basis point interest rate hikes are dampening price pressures.

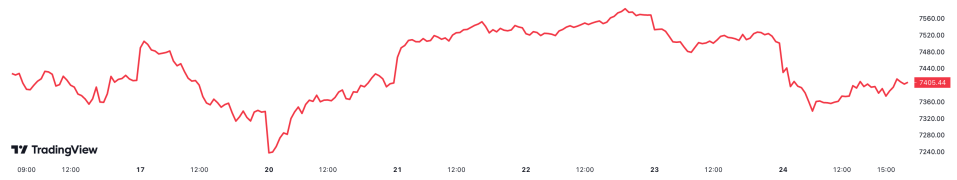

FTSE 100 edged lower last week

Latest data shows prices jumped 8.5 per cent across the bloc, among the quickest rises on record, although down from the peak of more than 10 per cent set back in the autumn.

London’s FTSE 100 was dragged into a global market sell off on Friday that saw it shed more than one per cent, dragging the premier index into the red last week. It finished at 7,405.77 points.

Elsewhere, Bank of England data on Wednesday is expected to show buyers tentatively returning to the housing market as mortgage rates come down following their huge spike as a result of Liz Truss’s mini budget.

Credit card lending is also likely to have jumped last month as families turn to debt to finance spending amid inflation hitting their budgets.

Final stateside GDP figures in the three months to December are also likely to be nudged higher to 2.8 per cent growth.

On the corporate front, retail bellwether Next posts final results for last year on Wednesday.