UK listed companies set for rebound after brutal pandemic hit

UK listed companies saw a record decline over the course of the Covid-19 pandemic, but recovery is already underway and predicted to rapidly pick up.

Investment manager J O Hambro Capital Management today said the pandemic was deeper and more widespread than any other downturn in recent history.

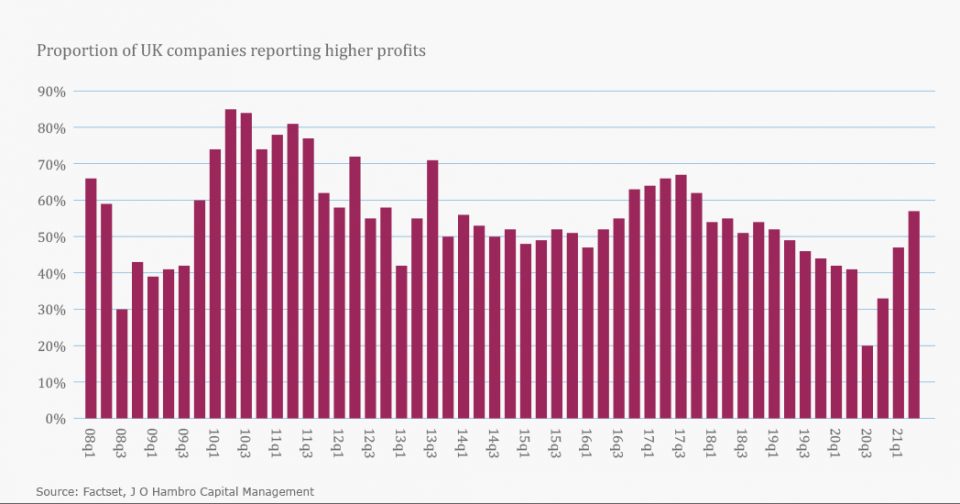

The impact of the coronavirus pandemic was estimated be eight times bigger than the 2008 financial crisis, with more than half of all companies seeing sales drop in four straight quarters.

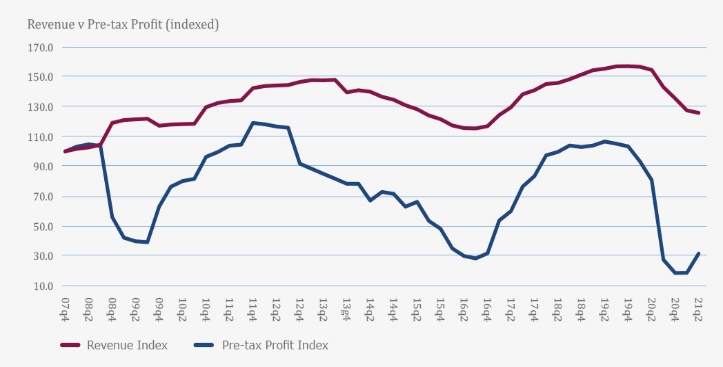

Company reporting showed that revenues were down £349bn for the first year of the pandemic. As a result, profits dropped 61 per cent in this same period.

Most of this decline is attributed to the collapse in oil prices, resulting in oil revenues falling 41 per cent (158bn).

However, the most recent results show positive signs of recovery, as companies began to bounce back from September last year despite still being under coronavirus restrictions.

All sectors saw profits pick up, but banks, oil and mining companies made the strongest contribution in the recovery.

The news comes as the Bank of England (BoE) said FTSE’s banking giants could once again pay out dividends, bigger bonuses and share buybacks, bookending the curbs placed on them at the start of the pandemic.

J O Hambro predicts the next set of UK results will show a “dramatic recovery” and that plc profits could double by spring 2022, returning to pre-pandemic levels the following year.

Alexandra Altinger, CEO (UK, Europe and Asia) for J O Hambro, said: “After the shock of the pandemic the change of mood in Britain’s boardrooms is palpable. The recovery is now very strong indeed: high government spending, low interest rates, strong consumer demand, resurgent employment and a buoyant housing market mean that profits are now growing very fast, much faster than market expectations.

“Surging profits are complemented by enticing valuations. All four J O Hambro UK equities teams agree that UK shares are attractively priced at present, both compared to historic levels and international peers. Valuations across the stock market appear cheap, and in some segments very cheap. Our fund managers are not simply interested in the cyclical upswing, however. They are looking for the companies that are honing themselves an edge for the long term, too. And they are finding them.”

Recovery from the Covid-19 pandemic has also boosted employers’ confidence to its highest level of hiring intention but increased concern over inflation.

Business expectations have risen to the highest level in six years as firms foresee an improvement in profits over the coming year.

The increased business optimism has pushed firms to make plans to boost investment and employment, with a net balance of 41 per cent of companies expecting to hire more staff in the coming year.

Confidence improved the most among construction firms, following manufacturers and services firms. These sectors expected the output would bounce back to the same or higher than the pre-Covid level.