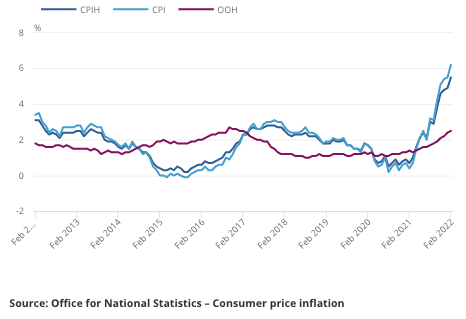

UK inflation climbs to more than triple Bank of England’s target

UK inflation has soared to more than triple the Bank of England’s target, piling more pressure on the central bank to launch further rate hikes.

Threadneedle Street is likely to pivot away from the dovish tone it set at its meeting last week after new figures published today by the Office for National Statistics (ONS) revealed inflation climbed to a new 30-year high of 6.2 per cent last month.

Experts had been expecting a reading of 5.9 per cent.

Rate setters at the Bank last week hiked interest rates for the third meeting in a row, but softened the wording of their forward guidance in a bid to temper market expectations for the pace of rate hikes this year.

However, the latest set of inflation data came in above the Bank’s expectations, marking another blemish on the monetary policy committee’s record of forecasting the rate of price rises.

“With inflation now more than three times the Bank of England’s two per cent target, the Bank may reassess its dovish tone after it raised interest rates to 0.75 per cent last week,” Paul Dales, chief UK economist at Capital Economics, said.

The new figures intensify the trade offs Chancellor Rishi Sunak is contending with as he prepares to deliver his spring statement at noon today.

Historically high inflation, compounded by tax hikes and swelling energy bills is forecasted to deal the worst hit to living standards since the 1970s, slowing the UK’s economic recovery from the pandemic in the process.

The fiscal watchdog, the Office for Budget Responsibility, is expected to downgrade its forecasts for economic growth this year due to households cutting spending amid tough inflation crunch.

Sunak is not expected to announce significant giveaways or cancel tax hikes to ease the cost of living despite being given a windfall of around £30bn to play with.

Although households are feeling the squeeze now, inflation is expected to reach eye-watering levels in the coming months, driven by Russia’s invasion of Ukraine sending oil and prices higher.

Some economists are pencilling in double-digit inflation in October, triggered by the energy watchdog hiking the cap on bills again to account for higher wholesale energy prices.

Next month, Brits will be hit by a double whammy of a 1.25 percentage point national insurance hike and a 54 per cent uplift to the energy price cap.