UK house prices: Stamp duty payments have fallen by half since George Osborne introduced reforms, but Londoners are missing out

The amount property buyers are paying in stamp duty has halved since George Osborne introduced new measures aimed at making homes more affordable in the last Budget – but Londoners are massively missing out on those savings, new research has found.

A study by the Post Office and the Centre for Economics and Business Research found that under the new rules, the average amount of tax people property buyers pay on transactions has fallen to £3,653, from £8,192 before.

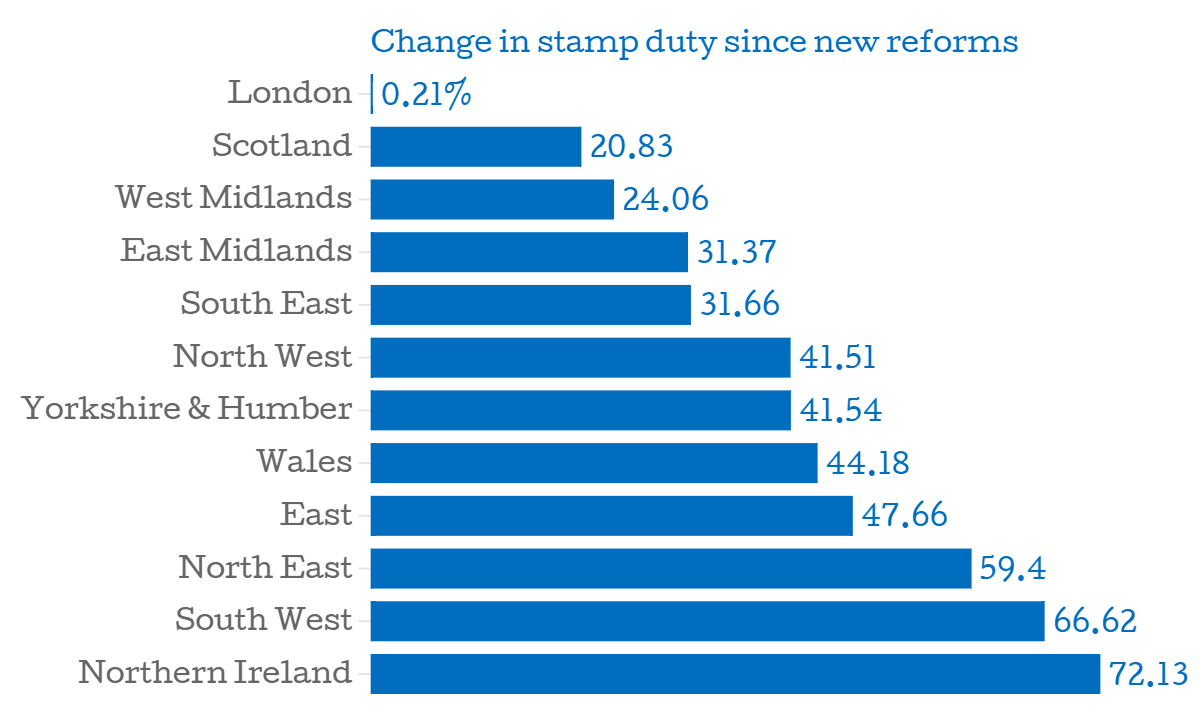

But the amount paid varies wildly depending on which region buyers are in. In London, stamp duty has fallen just 0.2 per cent, to £14,920 – in fact, three out of every five homes still being hit by higher rates are in the capital.

In the South East, the fall was a more respectable 31 per cent, from £10,170 to £6,950.

According to the study, stamp duty had risen 319 per cent since 2004, from £1,897 to £7,832 at the end of last year, meaning the chancellor's new measures will help 98.3 per cent of all buyers.

John Willcock, Post Office Money's head of mortgages, said there was "still significant debate" about how to help more people move up the housing ladder.

"The only way we can address the affordability of housing in the UK is by continuing to find innovative solutions to the costs faced by buyers and movers," he added.