UK exposure to Ukraine crisis extremely limited

The UK is facing only limited exposure to the crisis in Ukraine, according to a note from London-based consultancy Capital Economics.

The UK's direct trade with Ukraine is close to insignificant, with UK exports to Ukraine amounting to just 0.2 per cent of the total in 2012.

UK banks' are also relatively safe from exposure to Ukrainian and Russian debt, which accounted for a minuscule 0.01 per cent 0.5 per cent of their total foreign claims in the third quarter of 2013 respectively.

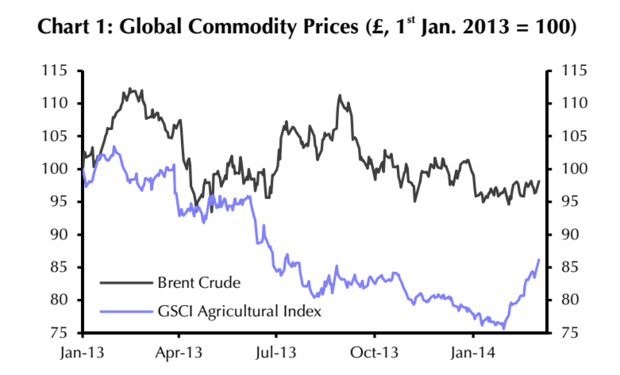

However, the UK does face risks from higher commodity prices but so far the crisis has failed to drive prices significantly higher. Agricultural commodities have risen two per cent while oil prices have remained flat.

The danger for the UK of an escalation of tensions in Ukraine or a policy of sanctions, could be a hike in energy prices.

Just over 10 per cent of the UK's crude oil imports come from Russia. Capital Economics believe that it is unlikely there will be a dramatic rise in oil prices in no small part due to the photographed documents indicating the UK government does not intend go down the road of sanctions with regard to Russia.

Should prices rise it is likely to be temporary, similar to the price rises seen during crisis situations in Libya and Syria. Capital Economics also make the observation that the UK's own domestic price pressures are already extremely weak.

UK economist Samuel Tombs concluded:

So while the crisis in Ukraine is perhaps a timely reminder that the global economic environment will not be particularly conducive to the UK’s economic recovery this year, as things stand it seems unlikely to knock the recovery off course. As a result, there remain plenty of reasons to expect the UK economy to outperform the rest of the G7 this year.