UK economic recovery heads to regions

BRITAIN’S economic recovery is continuing to intensify, with a raft of surveys this morning revealing increased optimism, growing consumer spending and growth across the UK.

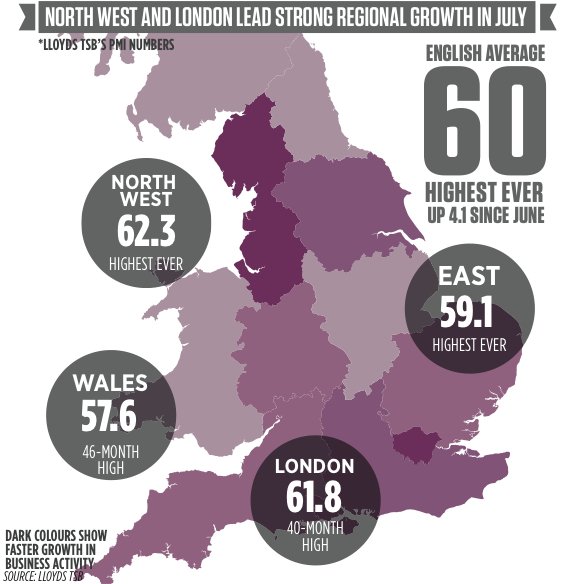

In a remarkable development showing that the rebound is now no longer confined to London and its commuter belt, Lloyds TSB’s regional purchasing managers’ index (PMI) for July implied the fastest-paced business growth in at least 12 years, with growth in every region of the country.

The bank’s survey recorded a score of 60, up 4.2 points from June. Anything above 50 indicates business expansion. Growth was strongest in the north west, which hit the highest level since the survey began, followed by London, at a 40-month high. However, every region recorded an improvement on the previous month.

The lowest score for any region was 56.4 in the north east of England, a figure that still points to robust growth and represents a 28-month high. Northern Ireland has started growing again and is at its strongest level in 70 months.

The BDO July business trends survey finds firms’ outlook for six months ahead at its most bullish in over a year, as firms expect to expand.

Indicators on output and employment have improved, and companies are less threatened by the spectre of higher inflation than they were a month before.

BDO partner Peter Hemington said: “All of our indices moved in the right direction this month, suggesting that the new Bank of England governor Mark Carney has joined at an opportune time”.

There were also signs that a nascent recovery is spreading to the embattled construction sector, with small and medium-sized firms reporting their first rise in activity for six years to the Construction Products Association. The group now expects output to rise 2.2 per cent next year.

Expenditure is up 4.8 per cent in the year to July, according to Barclaycard, in the third month of above-inflation increases.

But high spending is at odds with real, inflation-adjusted wages, which are still not recovering.

According to the House of Commons Library, real wages have fallen by 5.5 per cent in the last three years, the fourth biggest drop in the EU. Even France, struggling to escape recession, has seen real wages rise over the same period.