UK drops down post-Lehman financial transactions leaderboard

UK financial transactions have dropped by two-thirds over the past five years, according to a newly-published paper. In 2006/7, they were valued at $1.7 trillion (£1.1 trillion).

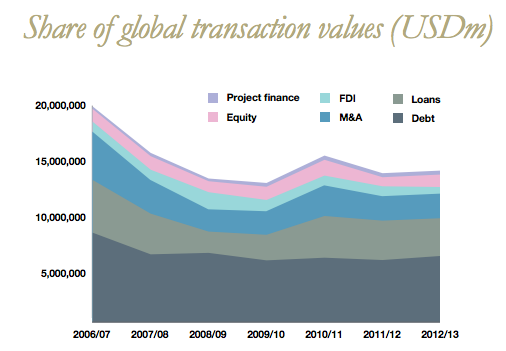

Law firm Allen and Overy have developed the Life after Lehman Index which looks at the value of global financial transactions, including bond and equity sales, five years on from the start of the crisis. (Release)

The US kept its number 1 spot: a $2 trillion value with transactions totalling $5.2 trillion.

The U.S. has proved to be less prone to execution risk perhaps because there is a deeper and more diverse pool of investormoney. It’s possible to find buyers for a wide range of business ideas, while investors in the UK and Europe still prefer stronger investments.

The UK has stayed behind Canada, Japan and China, all of whom have increased their numbers.

China remains second behind the U.S., but Western Europe, by contrast, has seen its share of global equity issues fall from 28% to 21%.

Global volumes as a whole have remained dented – 30 per cent lower in 2012/13 than they were before the Lehman collapse.