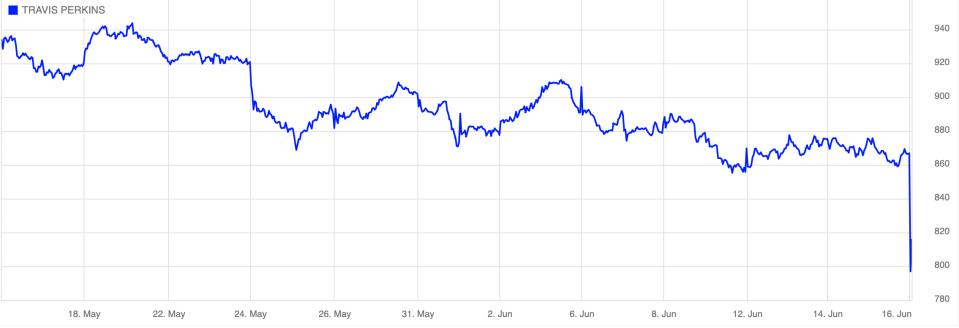

Travis Perkins’ share price tumbles with building supplier downgrading profits

Travis Perkins has warned investors to expect lower profits, with the UK’s biggest supplier of building materials downgrading its forecasts due to challenging market conditions.

The FTSE 250 firm attributed its downturn in earnings to lower than expected volumes of new build housing amid higher interest rates and weaker consumer confidence.

This has been driven by persistently high consumer price inflation – which has defied market expectations.

Assuming present conditions persist for the balance of the year, Travis Perkins’ management now expects to deliver a full year adjusted operating profit of around £240m.

Last year’s adjusted operating profits were £295m.

It confirmed that its hopes of market conditions in the second quarter of the year has not occurred.

The company’s shares slid over six per cent on the London Stock Exchange in early morning trading following the news – with shares priced at 813.4p.

Despite the gloomy headlines, Travis Perkins has announced resilient performance across its other end markets – including commercial, industrial, infrastructure and public sector housing – and Toolstation continues to perform in line with expectations both in the UK and Europe.

It hopes that targeted investment continues to ensure the group remains well placed to benefit from a recovery and the long term structural drivers in its end markets.

This includies the long term undersupply of new housing and the retrofitting of domestic and commercial properties.

Earlier this year, Travis Perkins has revealed it axed 400 jobs and shut 19 branches at the end of last year as a slowdown in the construction sector hit its bottom line.

The group, which owns the Toolstation chain, revealed it was forced to take some “difficult decisions” to slash costs by £25m this year.

The group will report half year results for the six months to 30 June on 1 August 2023.