Top US policymakers clash over Federal Reserve taper decision

TWO SENIOR figures from the US Federal Reserve revealed sharp disagreement over recent monetary policy in separate speeches yesterday, drawing the approach into question.

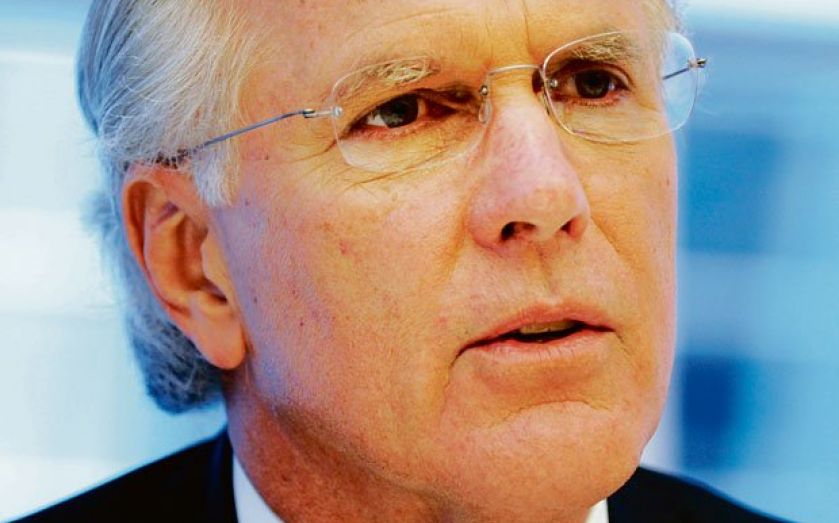

Richard Fisher, president of the Dallas Fed, said that the Fed’s decision not to taper QE had damaged its credibility. Fisher said that he urged the Federal Open Market Committee (FOMC), on which he is an alternate member, to slow down the pace of asset purchases.

He added that he believed a failure to taper, as was widely expected, would sow confusion and increase uncertainty.

However, in an earlier speech, FOMC vice chair William Dudley cast doubt over whether QE will be trimmed this year at all. Dudley said that the US is only healing slowly and “we have yet to see any meaningful pickup in the economy’s forward momentum.”

Echoing the Fed’s decision not to taper asset purchases this month, Dudley suggested that fiscal conditions have held the economy back, and that headwinds will not slow until 2014.

Dudley added: “In my view, the economy still needs the support of a very accommodative monetary policy.”