Top finance boss backs forced pensions savings

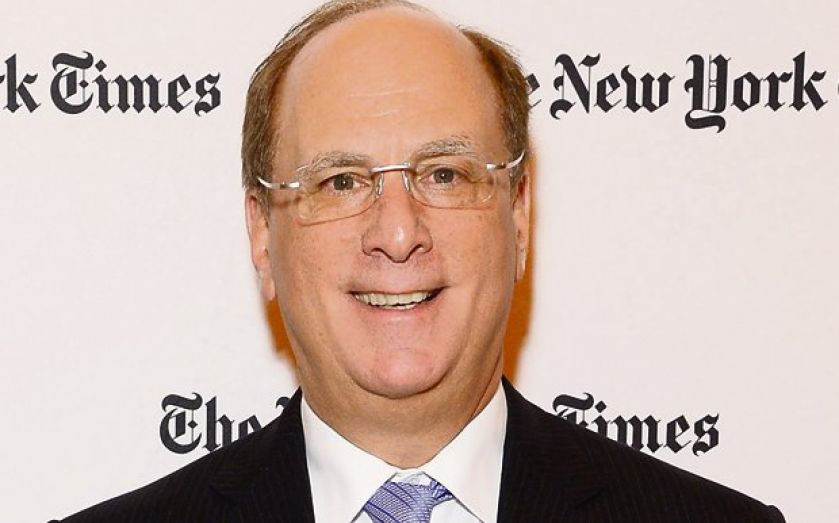

BLACKROCK chief executive Larry Fink weighed in on the UK’s grim savings outlook yesterday, suggesting the government make pensions saving compulsory, removing the option for workers to opt out of schemes.

Fink, whose firm is the world’s biggest money manager with $4 trillion under management, said otherwise there was “too much risk that people will either opt out, or not put enough away even if they remain in a plan”.

The compulsory system in Australia was “extremely effective,” he added. Alarming research published this morning by Scottish Widows also indicates that 19 per cent of people have no savings at all, up from 17 per cent last year. A further 15 per cent say they do not know how much they have saved.

“Many people are still only thinking in the short term, for instance, almost half of people said they prefer to spend their money rather than save, and almost two-thirds said they know they are not saving sufficiently for their long term needs. This problem is exacerbated by family pressures that eat further into people’s savings, particularly for those in the middle age groups,” said David Lascelles of Scottish Widows.

Those who did save had £10,208 in the bank on average last year, up from £10,033 in 2012. Only 12 per cent say they have been able to accumulate over £50,000 in savings, but the proportion rose from 11 per cent last year. Broken down by age group, one in four people aged between 35 and 44 say they have no savings at all, the highest of any bracket.

A third of the group say they are restrained from saving by the pressure of debts that they need to repay. The average person in this age grow owes nearly £6,000. The UK’s official savings ratio, which records savings as a portion of disposable income, fell from 7.8 per cent to 5.4 per cent in the year to the third quarter of 2013, indicating that consumers have begun to save less.