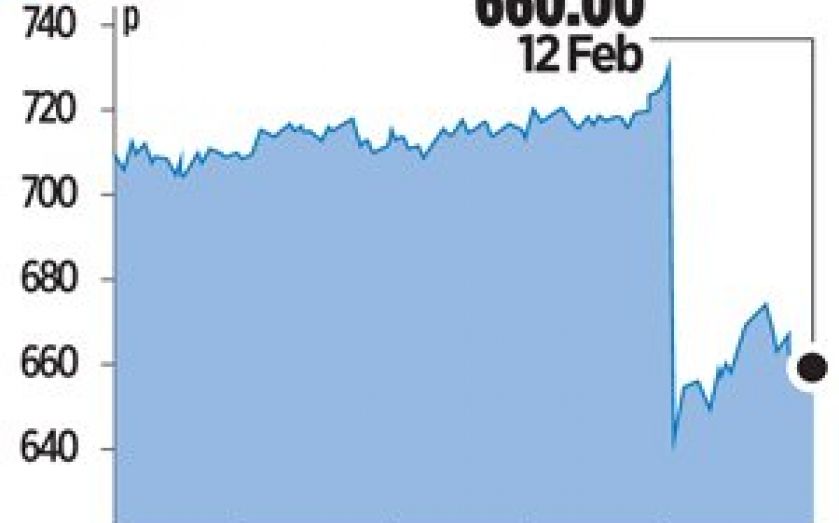

Telecity slumps as 2014 forecast fails to inspire

BRITISH data centre operator Telecity has forecast weaker than expected revenue growth this year, sending its shares down more than 10 per cent to a two-year low.

The company, which targets the top end of the market from prime city-centre locations, said yesterday that demand from sectors such as e-retail and video streaming services remained robust, and it expected 2014 revenue of £355m to £362m, up from £325.6m in 2013.

“We will continue to grow the company, with a strong focus on value creation through profitable growth, disciplined capital allocation and returns to shareholders,” said chief executive Michael Tobin.

Telecity reported a 15.1 per cent increase in 2013 revenue to £325.6m, missing expectations, and increased its dividend by 40 per cent to 7p a share.

“Telecity’s results confirms our view that in spite of a strong demand environment … the industry dynamics are deteriorating due to excess supply,” said analysts at Espirito Santo.

“We believe Telecity is seeing pressure from multiple angles – new entrants; wholesale providers and [the] trend of large customers self-managing their colocation details.

Investors are hoping for more detail on returns to shareholders which could come when the group appoints a new chief financial officer.

Tobin said a shortlist had been drawn up but it could be a few more weeks before an appointment.

Telecity was the biggest faller on the London Stock Exchange yesterday with shares closing down 9.6 per cent, to 660p a share.