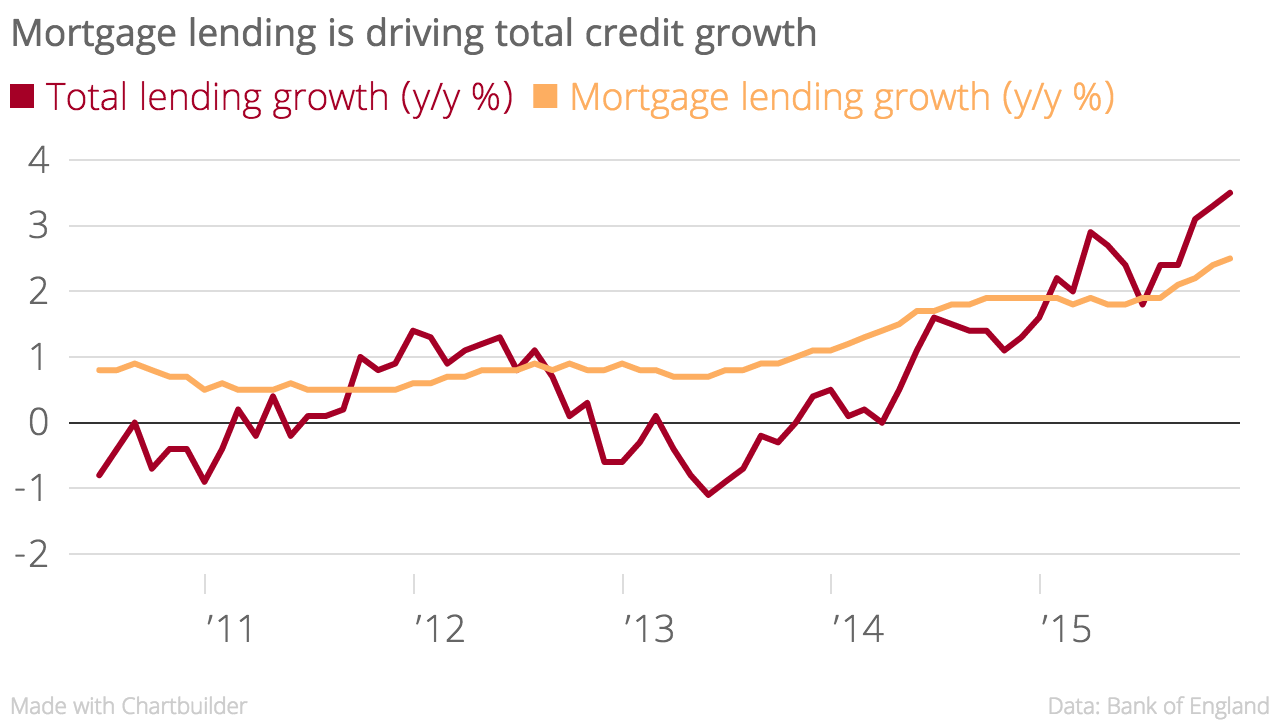

Strong mortgage market takes total UK lending growth to seven-year high

Mortgage lending is climbing at its fastest pace since 2009 with total UK lending now growing at its fastest rate for seven years.

Total mortgage lending in the UK climbed by £3.9bn in November, up 2.5 per cent on November 2014, according to figures released by the Bank of England this morning.

“Lenders’ appetite for new business grew significantly over the course of 2015, and this is expected to continue into 2016. This means those who meet affordability criteria will continue to enjoy the excellent deals available in the marketplace," said Brian Murphy, head of lending at the Mortgage Advice Bureau.

Unsecured credit – which is mostly overdrafts and credit card borrowing – rose to its highest level since 2008. Consumers borrowed an extra £1.5bn in November, up 8.3 per cent on the same month in 2014.

Despite the increase in lending to households and consumers, businesses are still struggling to borrow. Lending to large non-financial businesses fell 0.7 per cent while lending to small and medium-sized firms rose just 0.6 per cent on the year – a weak figure by historical standards.

Total lending in the economy to households and businesses by banks and building societies rose 3.5 per cent on the year in November – the highest since January 2009.

"These still-modest growth rates certainly do not suggest that another widespread credit bubble is emerging, and therefore should be interpreted as welcome sign that credit conditions are normalising," said Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy.