St James’s Place stands by its targets

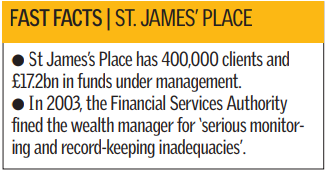

Wealth manager St James’s Place reported a 5.3 per cent fall in its first half profits, but chairman Mike Wilson said it was standing by its key long term sales growth targets, despite volatile market conditions.

Group operating profits at the wealth manager, which sells insurance and investment policies to affluent clients, fell to £114.2m in the six months to 30 June, from £120.7m the previous year.

The results beat the expectations of a panel of analysts hired by the company, who predicted profits of £111.2m. The wealth manager also defied analysts by reporting a record 3 per cent growth in new business, to £220.7m.

But the better than expected results did not help the shares, which closed 4.5p lower at 205p.

Chairman Mike Wilson said the company had performed better than expected in difficult times for the sector and was optimistic about the company’s prospects.

He said: “Financial stocks are under a cloud at the moment but our results are resilient. We expect similar growth in the second half of the year if market conditions continue.”

He predicted that a client base of wealthy long-term investors would stand the wealth manager in good stead.

“There are a lot of sophisticated investors sitting on a lot of liquidity at the moment,” he said.

Wilson said he was not worried by rumours that HBOS was planning to sell its 60 per cent stake in the business to prop up its ailing balance sheet.

“We have a good relationship with HBOS and if there were such discussions taking place, we would be aware of them,” he told CityA.M.