Sorare still confident of Premier League NFT deal and preparing US sports expansion

Sorare, the NFT-based fantasy football platform valued at $4.3bn last year, remains confident of signing a deal with the Premier League despite suggestions it had missed out.

The fast-growing French tech company has targeted licensing agreements with football’s top 20 leagues and already has contracts with Spain’s LaLiga and Germany’s Bundesliga.

NFTs – non-fungible tokens, or digital collectibles – have become hot property in sport, with the NBA’s wildly successful Top Shot video clips nearing $1bn in sales since July 2020.

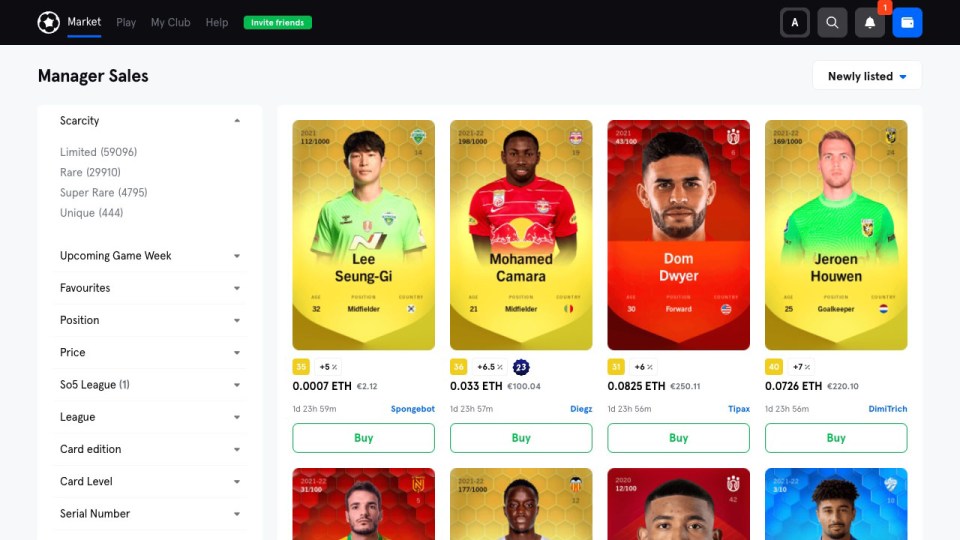

Sorare is one of the biggest issuers of football NFTs. Sales of its tradable digital cards of leading footballers have already passed $100m this year.

The Premier League launched a tender for two NFT partners last year and is reported to favour two other companies in the space, Dapper Labs, makers of Top Shot, and Consensys.

But Sorare co-founder and chief executive Nicolas Julia says it remains in talks with the English top division and believes there is room for more than two Premier League NFT products.

“Some conversations are taking longer than others,” Julia told City A.M.

“Some leagues are going to have two partners, other leagues are going to have three – all are going to have different strategies. What’s important to realise is that NFTs are a technology, not a market.

“There are ongoing conversations with all the top leagues. We have this goal to onboard the 20 leagues in football and are very confident that we’re going to make this happen.”

It is understood that the Premier League’s tender was for two specific types of NFT – video clips and still images – neither of which fit Sorare’s fantasy football-meets-trading card model.

Any deal with the English top-flight would therefore likely be separate to and, given the growth of the sector, in addition to any deals with Dapper Labs and Consensys.

The Premier League declined to comment. It is understood to be taking its time to choose the right partners, prioritising fan engagement and mass-market appeal.

Sorare last year raised $680m (£500m) in a record-breaking funding round that valued the company at $4.3bn. Investors include footballers Rio Ferdinand and Antoine Griezmann.

It plans to use it on a major expansion in North America, starting this summer. “We are going to launch two US sports this year and have deals with the leagues,” Julia said.

“Our vision is to unite sports fans around the globe around a player-owned gaming experience. The broader ambition for us as a company is to be the biggest brand in the world of sport and entertainment.”

Sorare’s rapid rise has caught the attention of regulators and the company remains the subject of enquiries from the UK Gambling Commission that began in October.

The value of its trading cards, which sold for an average of $102 last month, fluctuate according to a number of factors, including players’ on-field performance, but Julia says it is not gambling.

“If you look at the history of radical innovation – like Lyft, Uber, Airbnb – when you create a new market it’s normal to have inquiries from regulators,” he said.

“We expected it. They have very legitimate questions that we’re happy to answer and we’re doing that proactively in all the main jurisdictions in the world.

“At the same time, you need to be clear what you are and what you are not. We have nothing to do with gambling for many reasons and have been very clear about that.”

While NFT projects continue to flood into, there has been a significant backlash especially from some football supporters against them and other cryptocurrency-related brands.

Liverpool FC’s NFT issue earlier this month generated $1.5m in sales but shifted only around five per cent of the digital artworks of current players that the club made available.

Elsewhere, “fan token” company Socios has faced significant criticism and former England captain John Terry became embroiled in a copyright row over NFTs he promoted.

“I’m very clear where I want this company to be in 20 years, why utility or experiential value for NFTs is important. I think that sets us apart and is going to be the winning play,” said Julia.

“That said, when you have a radical innovation with some success in a growing market then you have behaviours that could be more short-term. That harms the whole community.”

On Liverpool, he added: “This NFT space needs more iterations, more trial and error. I think the intentions were right.”