Shore Capital in the money after markets boost

CITY finance firm Shore Capital yesterday said it doubled profits last year after a strong showing from its equity capital markets division.

The business, founded by Howard Shore in 1985, said the division saw its pre-tax profits rise up 19.4 per cent from £5.1m to £6m.

Overall revenues for the company rose nine per cent for the year ending December 2013, it said, rising £3m from £32.8m to £35.8m.

It helped increase the boutique outfit firm’s overall profits by 113.8 per cent to £5.4m for the year.

“Our business has continued to perform strongly, growing revenues and more than doubling profits. We have seen increased confidence returning to our markets as entrepreneurial management teams running businesses at all stages of development look to raise growth capital,” Howard Shore, now executive chairman, said.

“Based on the strong trading across the group and our pipeline, the board looks to the future with confidence.”

Shore added that this year had seen a strong start for the business. It was responsible for running the books on last week’s £750m float of budget retailer Poundland, one of the biggest in the City.

It also worked on last week’s float of biotechnology group Circassia Pharmaceuticals.

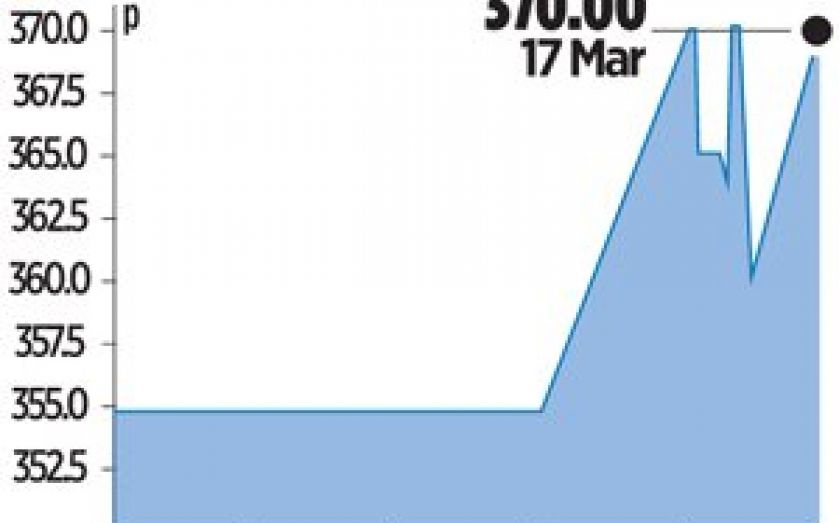

Last year it worked on two floats and a transfer to London’s alternative investment market, while its corporate finance division completed 30 transactions. Shares in the group, which is listed on the junior market, rose 4.3 per cent to close at 370p.