Severn Trent invests up to £1bn amid increasing scrutiny on water suppliers

Severn Trent expects to invest up to £1bn this year improving its infrastructure amid increasing scrutiny on water companies in the crisis-hit sector.

The FTSE 100 firm has posted a bullish trading update ahead of its full-year results in November, confirming work to strengthen its supply chains, source more water and boost engineering capabilities is well underway ahead of Ofwat’s next pricing window for households.

It expects to receive a rebate from the regulator of at least £50m for meeting customer service targets, while its debt gearing is among the leaders in the industry at the recommended maximum level of 60 per cent.

The supplier also confirmed it was on track to meet 100 per cent of its environmental performance commitments for this year, which includes sewage spills and water quality, with the aim of delivering the world’s first carbon-neutral waste water treatment works in 2024.

This follows Severn Trent being the only supplier to receive the highest four star rating from the Environmental Agency for its performance this year.

Reservoir levels across the company’s portfolio have risen to 77 per cent, more than 10 percentage points higher than at this point last year – making it well-positioned for the summer months when demand rises.

Liv Garfield, chief executive, said: “We recognise that there is more we can do and we are committed to going further, faster, to deliver the best possible outcomes for our customers and the environment. The business is well placed to deliver the progress needed with a highly engaged workforce, sustained operational leadership and a strong balance sheet, supporting future investment.”

The latest update comes amid sustained lobbying from suppliers for higher water bills to help fund investment plans to tackle storm overflows, upgrade pipelines and deal with rising demand over the long-term from global warming and rising population demand.

The industry is also grappling with historic levels of debt, with the Big Nine suppliers struggling under a £54bn debt mountain.

The UK’s largest supplier, Thames Water, home to 15m customers, has been scrambling for funds to shore up its operations – announcing a £750m reprieve last week before its bosses were hauled in front of a Westminster committee.

Severn Trent, which serves 4.6m customers in the midlands and Wales, has racked up debts of around £6.5bn, according to the latest figures, while Garfield’s pay has been under scrutiny amid criticism of fat cat bosses.

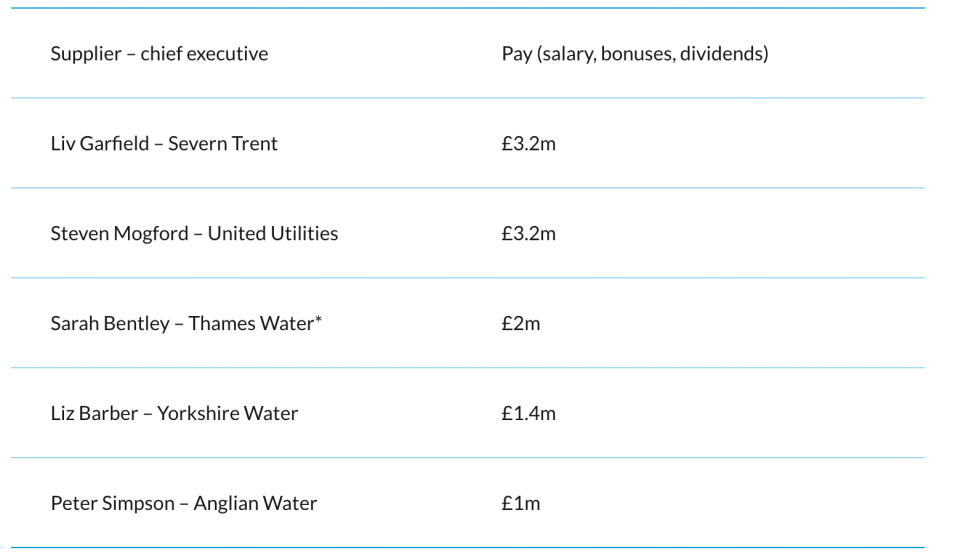

She is the highest earning water boss in the sector, taking home a hefty £3.2m pay packet last year.

Earlier this month, she reportedly invited other utility chief executives to an “off-the-record roundtable” with economist Will Hutton.

In confidential emails first reported by the Evening Standard, she outlined proposals for suppliers to remain privatised but be reformed as ‘social purpose’ vehicles with more stringent regulations funding and environmental concerns such as leaks – in a bid to fend off calls for nationalisation.