Screenshot: Will Facebook regret going nuclear over Australian news?

This week

**Media Moment of the Week: A jumbo jab mix-up

**Will Facebook regret going nuclear in Australia?

**Arm’s getting chippy

Media Moment of the Week: A jumbo jab mix-up

When Liam Thorp received a text inviting him for his first Covid jab he was confused, given the healthy 32-year-old is pretty low down the priority list. After calling his GP for clarification, it was soon established that doctors had Thorp’s height down as 6.2cm instead of 6”2, giving him a rather unflattering BMI of 28,000.

Had it been anyone else, this would likely have been nothing more than an amusing anecdote for whenever we’re allowed back in pubs. As luck would have it, though, Thorp is the political editor of the Liverpool Echo, so what ensued was this highly amusing write-up.

Will Facebook regret going nuclear in Australia?

If the character of General Ripper, the deranged air force commander in Dr Strangelove, were created today, he would probably have picked up his bizarre conspiracy theory about “precious bodily fluids” from Facebook. How fitting, then, that the escalating row between the social media giant and the Australian government has now gone nuclear in truly Kubrick-esque fashion.

After Australian politicians tabled draft new laws that would forced tech firms to pay publishers for use of their content, Facebook this week hit the big red button, blocking access to news in the country. It was the abrupt culmination of years of wrangling over news licensing amid concerns Facebook and Google have been gobbling up ad revenues at the expense of publishers.

While the shift to a more equitable system is a positive one, there are valid concerns about the minutiae of Australia’s so-called news media bargaining code. The draft laws would make tech platforms pay when any user posted a link to news content, not just when the companies displayed extracts or “snippets” of new articles. As Sir Tim Berners-Lee has pointed out, this would risk undermining a fundamental principle of the world wide web he founded — that linking to other pages should be free.

Putting this to one side, however, Facebook’s decision to launch a pre-emptive attack surely spells trouble. While the company had previously threatened action, it ultimately pulled the plug without any warning, leaving Australians suddenly high and dry. Moreover, its botched blackout ended up taking down key government health and emergency services pages as well, ironically, as some of its own pages.

Australian Prime Minister Scott Morrison was, unsurprisingly, rather miffed, branding Facebook “arrogant”, while industry body News Media Association accused the company of behaving like a “schoolyard bully”. For a firm whose reputation is already in a downward spiral, this isn’t exactly encouraging.

This, then, is where Facebook’s trouble lies. By throwing its undeniably massive weight around, the Silicon Valley tech giant has demonstrated just how much of a stranglehold it has over the media landscape — and done so with a remarkable lack of PR nous. At a time when global regulators have their gaze trained on Big Tech, Facebook is attracting all the wrong sorts of attention.

Ultimately, Australia’s laws need some revision, and further discussions will probably result in backtracking by the social media platform. A landmark licensing deal between Google and Rupert Murdoch’s News Corp empire this week also suggests that the feud between publishers and platforms could be settled without legislation. Australia is the canary in the coal mine, and the world is watching on.

What’s clear, though, is that Facebook has fumbled its response. Regardless of the outcome in this dispute, the tech titan’s petulant decision to black out news in the middle of a pandemic will surely come back to haunt it.

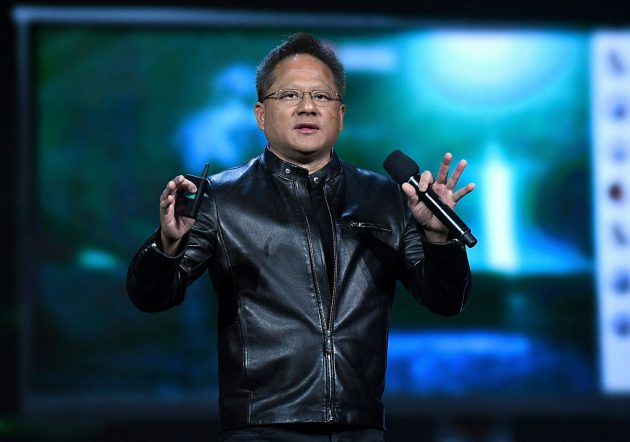

Arm’s getting chippy

Arm isn’t happy. The British chipmaker has decided that Hermann Hauser, who helped spin the company out of its predecessor Acorn, should not be described as a co-founder. Arm has contacted journalists with words to this effect, demanding that all references to Hauser as a co-founder be scrubbed from the record (while offering a Wikipedia entry as evidence). This new policy is, presumably, unrelated to Hauser’s highly-publicised assertions that Nvidia’s $40bn takeover of Arm would be a “disaster”.

If Arm seems a little jittery, that’s because the storm clouds are gathering, and its rivals are now lining up to take aim at the Cambridge-based tech firm over its mammoth merger with Nvidia. Google, Microsoft and Qualcomm are all said to have filed objections to the deal, which is now facing an in-depth competition probe in the US, as well as in the UK.

Arm, which designs chips for mobile phones, has gained a reputation as the Switzerland of the semiconductor world, remaining neutral while licensing its technology to firms including Nvidia and Intel. But the proposed tie-up has sparked concerns that Nvidia could be granted beneficial treatment, or even block its rivals’ access to Arm’s intellectual property altogether.

Then there’s a second wave of potential pushback over the sale of a prized British company (albeit one currently owned by Japanese conglomerate Softbank) to a US buyer. Former business secretary Lord Peter Mandelson last year described the deal as “short-sighted”, accusing the government of “selling off the crown jewels”.

For its part, Nvidia has said it will retain Arm’s neutral licensing model and has pledged to keep the company headquartered in the UK. With the sheer scale of regulatory scrutiny, though, it’s acknowledged the deal could take 18 months to complete.

It’s still unclear just how much opposition Nvidia is facing, but it seems likely that some form of concessions will be necessary to push the deal through. For the time being, though, it appears Arm is doing a little bit of reputational housekeeping. Maybe Facebook should take note.

The algorithm recommends:

- Fortnite maker Epic Games has filed an EU antitrust complaint against Apple, ramping up its war with the tech giant over in-app purchases.

- The value of British music exports is forecast to double to £1bn by 2030 thanks to a streaming-induced boom in music assets.

- The competition watchdog has raised concerns over the bumper £6.5bn classified ads merger between Ebay and Adevinta, which own Gumtree and Shpock respectively.

Got a story? Drop me a line at james.warrington@cityam.com or on Twitter