Risk on or risk off?

The next stage

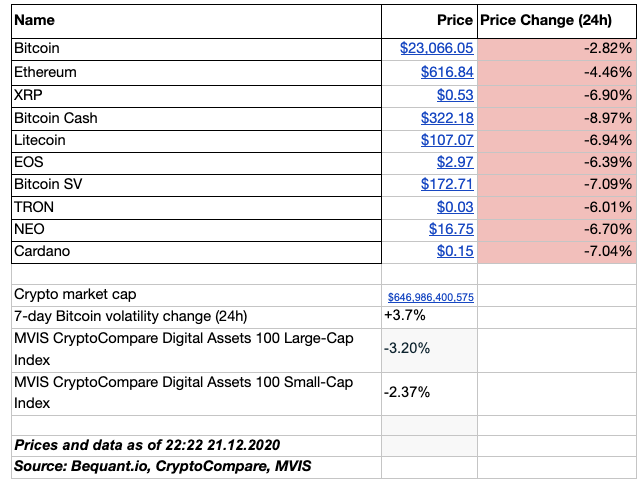

As expected, risk off tone dominated the price action as market participants reacted to the news of an aggressive spread of a new strain of coronavirus out of the UK, as well as further tensions between the EU and the UK ahead of the Brexit deadline.

As a result, GBP was hit hard across the board at the open, which when combined with EUR weakness that stemmed from uncertain macro impact, led to USD strength. This strength in turn caused market participants to unwind some of the long risk assets positioning and the crowded nature of digital assets resulted in a particularly violent compression.

All in all, this meant that it was not uncommon to see some assets trade with losses of close to 10%.

In the Markets

To the downside we go…

Interestingly, large and small cap indices traded more or less in lockstep to the downside and yet when the recovery ensued in the final hours of trade, it was the small caps that actually outperformed. This is usually a positive sign and indicates a healthy alpha seeking play by market participants.

The problem with crowded trades is that when position unwind takes place and it always does, very few are prepared to ride the subsequent volatility spike. Good thing that crypto natives are well accustomed to such formidable spikes in volatility, which is in part exacerbated by the nature of Bitcoin margined futures contracts.

Expect an unwind of momentum trades be met with plenty of dip buying from retail and the more opportunistic market participants, even if market timing is notoriously challenging.

Crypto AM: Longer Reads

Crypto AM: In conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Focusing on Regulation

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on CEX.IO