Regus steps up expansion but shares take a hit

REGUS boss Mark Dixon sought to ease concerns after the company announced yesterday it had brought forward its expansion plans, saying the benefits would far outweigh costs to the business in the short term.

The workspace provider, which runs around 2,000 centres across the world, said it expected to open at least 450 new sites this year compared with the 300 it had previously planned.

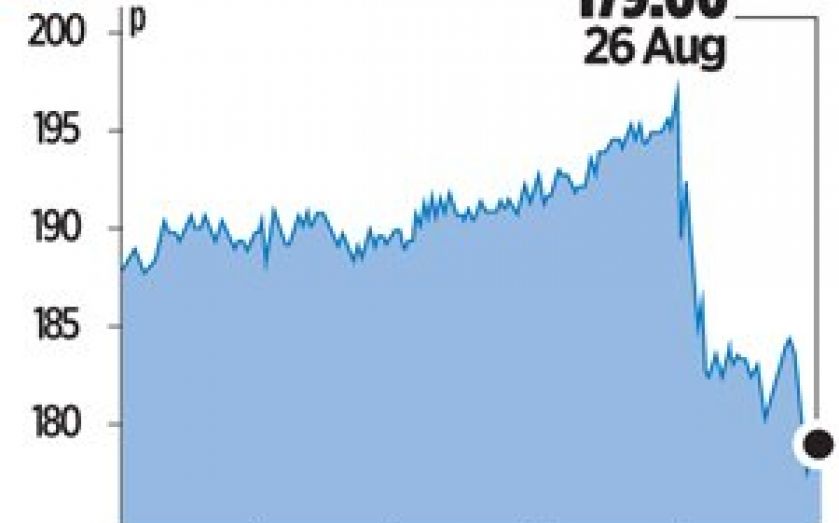

The news sent shares down 8.7 per cent on fears that the extra openings would increase debt and reduce earnings, JP Morgan analyst Andrea O’Keeffe said, forecasting a £40m cut to the consensus for pre-tax profits to around £80m.

But Dixon brushed off concerns: “This is a continuing of what we have been doing in the past and we think this is the right thing to do if we are going to grow.” He pointed out that previous investments were generating 25 per cent in annual returns.

Regus’s pre-tax profits rose 23 per cent to £31m in the six months to 30 June after stripping out the impact of currency headwinds.

Revenue grew by 16.9 per cent to £804.7m, driven by strong growth across its centres open at least a year.

Dixon said it would continue to target airports, libraries and shopping centres: “The fact is that fewer and fewer people are into offices because of changes to technology… it’s a worldwide phenomenon that is taking place.”