Punch Taverns risks defaulting if debt plan fails

STRUGGLING pub chain Punch Taverns yesterday unveiled a plan to restructure its £2.3bn debt pile with lenders, with executives warning the plan was the only alternative to defaulting.

The Association of British Insurers (ABI) hit out at the company’s actions, claiming that they had not seen the restructuring plans and only had limited interaction with Punch since the firm’s last set of proposals were rejected by bondholders in December.

Punch Taverns said that it had taken stakeholders feedback onboard since December in its final proposals and added the total period of stakeholder engagement over its debt lasted 14 months.

Like many pub firms, Punch was hit hard by the country’s downturn after building up a considerable amount of debt during an acquisition spree before the economic downturn.

“We believe that the restructuring is in the interests of all stakeholders and delivers a materially better position than the alternative of a default,” said Punch Taverns executive chairman Stephen Billingham.

Punch’s proposed debt structure is complex, with debt split into two securitised vehicles, Punch A and Punch B, and bondholders had already rejected a proposal put forward early last year.

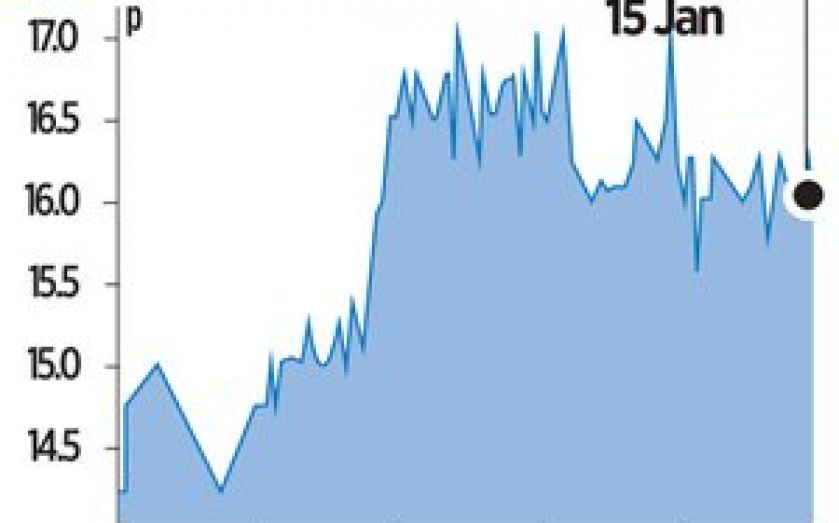

Punch Taverns share price fell 1.5 per cent yesterday on the news to close at 16p a share.

Bondholders will vote on the restructuring proposal on 14 February.