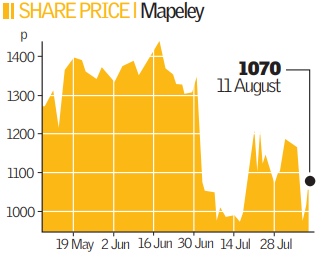

Property fillip for Mapeley

Property outsourcing and investment firm Mapeley bucked the trend in the battered property market and saw its funds from operations (FFO) rise 129 per cent to £63.1m yesterday.

The firm, which counts HM Revenue & Customs as one of its clients, posted the large rise in funds from operations – a key measure that demonstrates the performance of a property company – despite the protracted slump in commercial property.

Values have fallen by around a fifth since last summer when problems in the American sub-prime mortgage market first emerged.

Mapeley, which is valued at around £300m, posted a pre-tax loss for the six months to June of £53.8m versus £30.2m for the same period last year, mainly due to the declining value of its portfolio. It took a £82.8m write down on the value of its assets.

“Our business is underpinned by strong income streams and long term relationships with our clients. 92 per cent of our income is from government and investment grade corporates and our average lease length is 10 years. Our portfolios continue to offer opportunities to create value, even in challenging markets,” the company said in statement.