Pressure piles on EDF to hike offer for BE

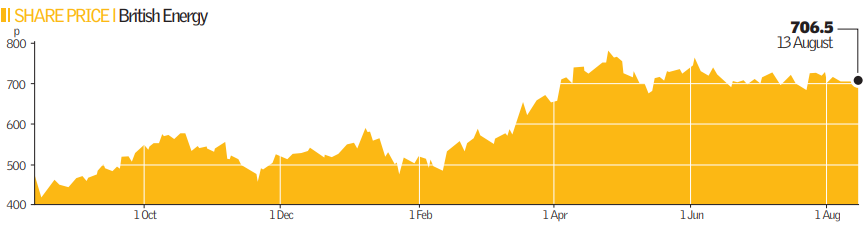

Sources close to British Energy said yesterday rival French firm EDF would have to raise its offer for the electricity giant to above 800p per share, if it is to have any hope of buying the group.

Earlier this month shareholders of British Energy, which holds the key to Britain’s next generation of nuclear power stations, rejected a 765p a share offer from EDF, in a deal worth £12bn. Despite this, British Energy confirmed yesterday it is still in talks with an unnamed suitor, widely believed to be EDF.

“Advanced discussions continue in connection with a potential offer for the company. British Energy remains uniquely positioned to play a pivotal role in nuclear new build,” the company said in statement.

But a source close to British Energy said the French firm would have to sweeten its offer considerably, before hardline shareholders would consider a bid.

“I think they (EDF) will have to put an eight in front of it,” the source said. The race to take control of British Energy effectively begun last year when the government put its 35 per cent stake in the nuclear generator up for the sale.

British Energy chairman Sir Adrian Montague has played a key role in the battle for the company. He has always maintained that EDF’s offer did not represent value for shareholders.

Yesterday, British Energy, hampered by outages at its reactors, posted a 66 per cent fall in quarterly profits to the end of June from £296m to £101m.

Analysts defended the better than expected results, saying the firm’s profits would recover next year, as the reactors returned to their full capability.

Lakis Athanasiou, analyst at Evolution Securities, said rival European power firms would have done no better in resolving the problems at British Energy’s nuclear plants. “EDF brings nothing to the party technically but a large, state owned utility like EDF would be able to provide the finance for British Energy to build more nuclear power stations,” he said.