UK a ‘nation of savers’ following surge in inflation, research shows

Households responded to the largest surge in inflation in decades by ramping up their savings rather than increasing borrowing, new research from the Resolution Foundation shows.

Since March 2021, prices have increased by 22 per cent in the UK with a peak annual inflation rate of 11.1 per cent in October 2022.

This means the UK has suffered one of the worst bouts of inflation among OECD countries.

Rather than running down savings or borrowing to cope with higher prices, households have cut back on spending. Since the pandemic, real household disposable income per person has fallen by 1.1 per cent while real consumption per person has dropped 4.7 per cent.

The analysis showed that households have cut spending on both essentials and luxury products compared to levels at the start of 2022. Spending on energy and food fell 11 per cent and seven per cent respectively. Spending on delayable purchases, like household appliances, has dropped 18 per cent.

As spending has decreased, savings – the difference between disposable income and consumption – has increased significantly.

This will partly reflect the increase in interest rates, which has made it much more attractive for households to save relative to recent years when rates were near zero.

In the final quarter of 2023, UK households saved 6.0 per cent of disposable income, nearly double the savings rate in the first quarter of 2022 and the highest level of savings since 1993, excluding the pandemic.

If savings had remained at the 2019 levels, aggregate spending would have been lifted by £54bn.

“Inflation has also turned us from a nation of spenders to a nation of savers, with credit card spending falling by 13 per cent, and families saving around £54bn a year more than we might have expected,” James Smith, research director at the Resolution Foundation, said.

Looking internationally, economies which have seen an increase in savings relative to pre-pandemic levels have seen slower rates of economic growth.

“This is consistent with the idea that the UK’s sluggish post-pandemic recovery is a key factor behind the recent rise in saving,” the think tank said.

Shadow energy secretary Ed Miliband ‘not aware’ Russia found oil and gas in Antarctic

Ed Miliband has said he is “not aware” of the reports Russia discovered huge oil and gas reserves in the British Antarctic territories.

The shadow energy secretary was asked by City A.M. whether he had concerns about the finding by Russia of some 511bn barrels worth of oil could lead to drilling in the pristine region.

Miliband said: “I’m not aware of that, it’s obviously something I’ll have to look at.

“I think we’ve got a very, very clear position on the role of Russia in British territory, which is not something we’re in favour of.”

The discovery via Russia’s research ships, which equates to 10 times the North Sea’s output over the last 50 years, emerged in evidence submitted to the Commons Environment Audit Committee last week.

And the former Labour leader, speaking on a visit to Barnet, in north London, following Sir Keir Starmer’s announcement of Labour’s six “first steps for change”, also insisted he “disagrees” with criticism of the party’s plans for a windfall tax on the oil and gas giants.

David Whitehouse, chief executive of Offshore Energies UK (OEUK), previously warned that Labour’s new tax plans could risk up to 40,000 jobs and that the party “either can’t do the maths or haven’t considered the alarming jobs impact”.

Miliband responded: “I disagree with David. I have a good relationship with David and OEUK and we talk a lot about these issues.

“We think it is the right thing to do to have a proper windfall tax on the huge profits the oil and gas companies have made and then all of that money is going to go back into clean energy jobs because what that is funding is GB Energy.”

He added: “I know David actually is interested in this because he represents the whole of the offshore sector.

“If we’re going to get ahead in the jobs of the future whether it’s hydrogen or carbon capture, or offshore wind, we need to have that partnership between government and private sector.

“We’ve said on the North Sea that we’re going to carry on with the existing North Sea oil and gas fields which will be with us for decades to come.

“We continue the dialogue with OEUK and others, but we think there is a bright future for North Sea communities, but the future of those communities will be determined by whether we invest in those future jobs.”

Miliband also rejected suggestions that Starmer’s ‘pledge card’ style campaign was retro, or reminiscent of Tony Blair’s strategy in the 1990s, stating: “I think it’s future not retro.

“I don’t think that it’s retro because in 1997 the world was very different. [Setting up GB Energy] wasn’t one of our pledges in 1997 because climate change was obviously an issue but it wasn’t the kind of issue that it is now.

“Also, I don’t think we were as aware as we are now of the huge global race there is on jobs of the future in this area. So I think it’s very much about the future – and it’s about the 2020s and 2030s, not about the 1990s.”

Reflecting on his own leadership, Miliband insisted: “That was 10 years ago, a long time ago.

“The world is very different. What I’m interested in doing and what I’m 100 per cent focused on is making my contribution to Labour’s election campaign as part of Keir Starmer’s team.”

He added: “And if I’m the shadow energy security and net zero secretary after the election, doing a good job in ensuring that we take advantage of the huge opportunity there is.

“The argument I would have made to you 10 years ago about climate is a different argument that it makes you today because then it was the right thing to do for the long term economics of the country, and ethically obviously.

“Today it’s the right thing to do short term and long term as well as ethically because we’ve just been through and families are still going through this terrible cost of living crisis.”

FTSE 100 today: London markets set for muted opening as global stock rally cools down

Moving markets today: Asian markets dip as Wall Street rally falters; oil prices surge, Reddit shares soar, China’s April new home prices plummet; Attention turns to Land Securities earnings and EU inflation data

US stocks took a step back from their recent record high, ending a streak of gains driven by signs of inflation easing. Asian stocks also saw a decline, uncertain about the timing of potential US rate adjustments. However, oil prices are set to climb for the week due to improving demand, while gold prices are on track for their second weekly rise, influenced by the Federal Reserve’s rate expectations. In China, new home prices in April fell at the fastest rate in over nine years, reflecting a mixed economic picture for the country. Bank of Japan Governor Ueda stated that there are no immediate plans to sell ETF holdings. Meanwhile, Reddit’s shares surged after securing a content deal with OpenAI. Investors are eagerly awaiting consumer price data for the euro area, along with speeches from multiple Fed speakers. Additionally, attention is on Land Securities (LAND), a major UK real estate company, as it prepares to release its financial results. Here are five key takeaways for your day.

China’s April economic metrics disappoint, sparking recovery worries

China saw the steepest monthly drop in new home prices in over nine years in April, despite efforts by authorities to stabilize the property market. Prices fell by 0.6 per cent from March, the sharpest decline since November 2014, marking the tenth consecutive monthly drop.

Despite these challenges, China’s industrial output surged by 6.7 per cent year-on-year in April, outpacing expectations. However, retail sales only rose by 2.3 per cent, lower than analysts’ forecasts. Fixed asset investment also fell short of expectations, expanding by 4.2 per cent in the first four months of 2024 compared to the same period last year.

BOJ Governor Ueda said no immediate plan to sell ETF holdings

Bank of Japan Governor Kazuo Ueda has said that the central bank doesn’t have any immediate plans to sell its large stash of exchange-traded funds (ETFs). This has become a topic of interest as a potential source of income to back government projects. The BOJ currently holds around 37 trillion yen worth of ETFs. Estimates from January suggest that the market value of these holdings is approximately 67 trillion yen, indicating a potential profit of around 30 trillion yen that has yet to be realized.

Reddit shares soar after content deal with OpenAI

OpenAI and Reddit have struck a deal allowing OpenAI to utilize content from Reddit’s platform for its AI chatbot. This news caused OpenAI’s shares to rise by as much as 15 per cent in after-hours trading, the FT reported.

The announcement, made on Thursday, is part of OpenAI’s ongoing efforts to secure reliable data for its powerful AI models. This collaboration adds to a series of partnerships between OpenAI, supported by Microsoft, and various media brands.

However, OpenAI is currently facing legal challenges from publishers who are reluctant to grant permission for their content to be used by OpenAI’s ChatGPT. The agreement grants OpenAI access to Reddit’s content and allows Reddit to incorporate more AI tools into its platform.

What’s coming up

Eurostat will release April’s consumer price data for the euro area, followed by several speeches from US Federal Reserve officials throughout the afternoon.

Land Securities (LAND), a leading UK real estate company, will also be in the spotlight as it announces its financial results. The company’s stock has climbed 50 per cent from its lowest point in 2022. Recently, Land Securities revealed a £400 million sale of its hotel portfolio, indicating a strategic shift toward its core strengths.

Investors are eager for more information on market rental growth, potential property sales, funding for its Southbank office projects, and future plans for urban mixed-use developments.

Asian markets decline as Wall Street rally loses steam

The Dow Jones Industrial Average dipped 0.10 per cent to 39,869.38, while the S&P 500 and Nasdaq Composite dropped 0.21 per cent and 0.26 per cent to 5,297.10 and 16,698.32, respectively. Most sectors in the S&P 500 saw declines, with consumer staples being the only sector to close with gains.

Walmart’s stock surged 7 per cent after the company raised its sales and profit outlook for fiscal 2025, anticipating that lower inflation will boost demand for essentials. Conversely, Deere’s stock fell 4.8 per cent after the company reduced its annual profit forecast for the second time.

Shares of Swiss insurer Chubb, listed in the US, rose 4.7 per cent following Warren Buffett’s Berkshire Hathaway’s announcement of a $6.7 billion investment in the company. Meanwhile, meme stocks GameStop and AMC Entertainment plunged 30 per cent and 15 per cent, respectively, extending their losses from a previous rally sparked by the return of “Roaring Kitty” Keith Gill on social media.

In Asian markets, Hong Kong stocks climbed on Friday morning ahead of the release of Chinese economic data. The Hang Seng index increased by 1.1 per cent, supported by gains in Chinese tech and property firms.

The Hang Seng Mainland Properties index surged 2.5 per cent, accumulating a 7 per cent gain for the week amid rumours that the Chinese government would purchase properties from developers. The Hang Seng Tech index also rose by 1.8 per cent. On the other hand, Japan’s Nikkei 225 declined by 0.48 per cent, while China’s CSI300 blue-chip index edged up 0.15 per cent in early trading.

In commodities, oil prices rose during Asian trading hours. Brent crude was poised for its first weekly gain in three weeks, buoyed by signs of improving global demand and slowing inflation in the US US crude increased by 0.23 per cent to $79.41 per barrel, while Brent crude went up by 0.37 per cent to $83.58 per barrel.

Gold prices were last recorded at $2,374.19 per ounce.

China’s April economic data disappoint: recovery in domestic demand hits a snag

China faced a bit of a setback on the economic front in April, disappointing market expectations. While there was some positive news in terms of industrial output, other key indicators like retail sales and investment figures didn’t quite meet the mark.

China’s factories were buzzing, with industrial output growing by 6.7 per cent in April compared to the same time last year. This exceeded forecasts and hinted at improving demand, especially from international markets.

However, on the flip side, retail sales didn’t keep pace. They only increased by 2.3 per cent, the slowest growth since December 2022. This was a bit of a downer compared to March’s 3.1 per cent uptick and fell short of what analysts had predicted.

“Overall, the data releases for April indicate that the caution entrenched over the past several years will take some time to recover. As the weakness of the earlier published credit data hinted, today’s key activity data pointed to private-sector and household sentiment remaining downbeat and holding back overall growth,” said Lynn Song, Chief Economist, Greater China at ING.

“In 2024, growth will likely have to be driven by the public sector; fortunately, the policy rollout has begun, and the impact of supportive policies should gradually begin to trickle through the economy in the months ahead. There remains work to be done if China aims to hit its 5 per cent growth target in 2024.”

Investment numbers also missed expectations. Fixed asset investment grew by 4.2 per cent in the first four months of 2024, below the anticipated 4.6 per cent rise. The property sector, in particular, continued to be a drag on the economy.

New home prices saw the sharpest decline in over nine years, and property investment dropped by 9.8 per cent compared to the same period last year.

Despite these challenges, there were still some positive signs. Infrastructure and manufacturing investments, while slightly slowing down, continued to contribute positively to the economic landscape.

The urban unemployment rate remained at 5 per cent in April, with further breakdowns expected later. Overall, the data painted a mixed picture, urging Beijing to consider additional measures to support economic growth.

“The economic drag from the housing downturn may ease somewhat. Depending on how quickly they are rolled out, government efforts to destock unsold properties could provide some near-term support to new home sales. And with the labour market tightening again…consumer spending may regain some momentum,” said Zichun Huang, China Economist at Capital Economics.

“But none of this is likely to prevent a renewed slowdown further ahead, with property construction still on course to contract significantly over the coming years and China unlikely to continue rapidly gaining global export market share indefinitely.”

Natalie Elphicke wasn’t worth it

Keir Starmer will regret alienating Labour Party members and women’s rights campaigners by welcoming in the morally and politically tainted Natalie Elphicke, says Morgan Jones

The words “new Labour MP” are music to the ears of many on the left – unless they are followed directly by “Natalie Elphicke”.

A former member of the European Research Group from the right of the Conservative Party, Elphicke hit the headlines in 2021 for criticising Marcus Rashford, who she accused of “playing politics” after his school meals campaign. Her parliamentary career has been most marked out, however, by her involvement in the trial of her husband, and predecessor as Dover MP, Charlie Elphicke.

Mr Elphicke was convicted of three counts of sexual assault in 2020. Natalie Elphicke was temporarily suspended from the Commons in 2021 for attempting to influence the judge in her husband’s trial; she backed his appeal, telling The Sun at the time that “Charlie is charming, wealthy, charismatic and successful — attractive, and attracted to, women. All things that in today’s climate made him an easy target for dirty politics and false allegations”. Since defecting, she has apologised for what she had said: she’s also been accused by then-Justice Secretary Robert Buckland of attempting to lobby him on behalf of her husband.

The reasoning behind welcoming Natalie Elphicke into the Labour Party is obvious: she’s the MP for Dover, and Labour, generally feeling itself to be at a disadvantage in immigration and asylum debates, wants the upper hand in rows over small boats, along with the general embarrassment to the Tories a defection causes. This would be fair enough if Elphicke were and other Tory MP – if she were, for example, Dan Poulter, the Central Suffolk and North Ipswich MP who unobtrusively defected to Labour some weeks ago, to a pleased murmur from Labour MPs and members alike. But she is not. Her politics are notably more extreme; her support for her husband through his sexual assault conviction and her smearing of his victims means that she is both morally and politically compromised.

There are those who argue that Keir Starmer is being pragmatic in welcoming into the fold and that it is the right move strategically. They think that the trade-off is worth it, that this is smart politics. I don’t.

Firstly, consider the polling. Labour is on course to win; the Tories have just been wiped out in the locals. Labour doesn’t need to do anything big or showy – it doesn’t need to take risks, like, for example, admitting a former ERG member – to stay on track. Elphicke won’t stand again so with or without her defection the result in Dover is in all likelihood the same: the party’s candidate Mike Tapp will be elected at some point between now and January. Elsewhere, in the places around the country where Labour lost ground to the Greens at the locals (something General Secretary David Evans has discussed the need to work on), one can easily imagine leaflet attack lines about the party welcoming hard right Tories.

Tory sleaze has been a consistent, and winning, attack line for Labour in the last few years. It was, after all, Tory sleaze – the Pincher affair – that finally brought down Boris Johnson. Labour has won by-elections in Wellingborough, Wakefield, Tamworth and Blackpool campaigning to replace MPs who had fallen foul of the standards commissioner or the law. Lines about standards in public life, and doing things differently, don’t really work if you invite the sleaze in (far from incidentally, Elphicke also had a lucrative 2nd job while an MP, another thing Labour has been vocal about opposing). As Buckland’s lobbying disclosure clearly illustrates, the story of Elphicke’s involvement in her former husband’s trial is not a closed matter: more may very possibly come out, and when it does it will be the Labour Party’s problem.

The decision to let Elphicke become a Labour MP has been met with a mixed response within the party (Labourlist’s readers’ poll found more than 76 per cent thought it was the wrong call). Many people who have spent years in the party fighting for migrants’ rights, or a safer internal party (sexual harassment lawyer and former Labour aide Deeba Syed wrote that Labour’s new MP “abused her position of power and privilege to interfere with the criminal justice process”) or trade union rights (the TUC president described her views and past positions on trade union rights as “incompatible” with the party) feel a very raw anger that the door was opened to this person whose entire career has been a rebuke to them.

If you think this is an irrelevant consideration that big and clever politics can put aside, it isn’t: volunteer hours make the difference in tight races and internal discontent being aired in the press is not good. The leadership should treat the party it’s attached to as a resource, not a nuisance. It’s inevitable that sometimes the leadership will annoy the party: deciding when it’s worthwhile to spend political capital to do so is important. Natalie Elphicke, trailing days of stories about sexual assault, second jobs, and internal hypocrisy across the Labour party’s generally clean, well-polling floor, is not a good use of that capital.

Sony Music Group open to licence agreements with AI developers

Sony Music Group has said it is open to licence agreements with artificial intelligence developers, after it sent out formal letters to over 700 AI companies to take a stand against the use of its music being used without consent.

The letters, sent today, make it “expressly” clear that the recording giant is opting out of any so-called text and data mining (TDM) of its content for any purposes, including for training, developing, or commercialising AI systems.

Sony, which represents artists including Travis Scott, Adele and Bob Dylan, said it is open to discuss licence agreements with any developers that would like to train on its music content.

It has also issued a public declaration online, saying “innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.”

Sony Music is a “passionate believer in the inherent and paramount value of human artistry,” the declaration stated, adding that the company supports AI as a creative tool when used responsibly.

Under the EU AI Act, and in many other countries, the onus is on copyright owners to publicly opt out of their content being used to train AI models.

Sony plans to continuously send letters to AI developers to make them aware that permission to use its content is required in advance.

Recently, Sony joined Universal and a number of other companies to launch a website designed to empower record labels to safeguard their copyright. It also warned technology businesses engaging in the “unlicensed exploitation” of their content.

And MPs have called for a new law to stop AI firms “deceiving” music fans by releasing deepfakes or AI-generated music and to protect creators from “theft”.

HS2: Cancelling London Euston section would pile pressure on Elizabeth Line, advisers warn

Cancelling the Euston section of HS2 would leave Londoners too reliant on an already struggling Elizabeth Line, government advisers have warned.

The National Infrastructure Commission said failure to terminate the route at Euston presented a “resilience risk” in the case of disruption or closure of the Elizabeth Line, “as there are fewer alternatives at Old Oak Common for onward travel.”

“If High Speed 2 terminated permanently at Old Oak Common, this would further increase the number of users on the Elizabeth Line travelling east to London, limiting its potential to support wider passenger growth in future.”

Prime Minister Rishi Sunak sparked national controversy in October when the government cancelled the northern section of HS2 amid ballooning costs.

Alongside ongoing doubt and delay surrounding the Euston terminus in Central London, it became a real risk that HS2, the budget for which is now north of £100bn, would only run from Birmingham to Old Oak Common in the UK capital’s Western suburbs.

“The necessary funding must now be secured for the tunnelling from Old Oak Common to Euston to avoid incurring greater costs from stopping and restarting work,” the NIC wrote.

“Permanently terminating High Speed 2 services at Old Oak Common has not been planned for and would provide poorer connectivity to many onward destinations in London.”

It was reported earlier this week that the government had found a way to fund the 4.5 mile tunnel required for the link. This has yet to be officially confirmed but the report suggested taxpayers would be forced to dish out over a billion despite a prior pledge private investors would deliver the funding.

Warnings over extra pressure on the Elizabeth Line come amid ongoing issues with delays and cancellations through its post-honeymoon period.

Data in September from the Office of Rail and Road found the Elizabeth Line had a higher cancellation rate between July and August than any other train service in the UK.

Persistent disruption in recent months has threatened to take the shine of a remarkably successful first year in operation.

Damage to overhead power cables and track upgrades along the route, which is overseen by Network Rail, have caused issues since the end of last year. London Mayor Sadiq Khan warned in January the Elizabeth Line had “not met” standards expected by Londoners.

Issues with rail infrastructure have simultaneously plagued the West Coast Mainline, which provides connecitivty between London, Birmingham, the North West and Scotland and is the busiest rail freight corridor in the UK.

Following the cancellation of HS2’s northern leg, the NIC warned a “do nothing” scenario for the route north of Handsacre, HS2’s new terminus, is “not sustainable” as passenger demand grows over the long term.

“It is already running at a higher intensity of operation than major fast lines in other European countries, impacting reliability,” the NIC said in its annual review of British infrastructure.

Bottlenecks between Manchester and Birmingham, such as Colwich junction, Crewe and the southern approach to Manchester, are limiting capacity growth, preventing any growth in passenger numbers without additional infrastructure investment.

“The government should maximise the benefits from High Speed 2 infrastructure between London and Birmingham by examining options to increase capacity north of Birmingham,” the NIC said.

FTSE 100 trounces US and Europe since start of interest rate hikes

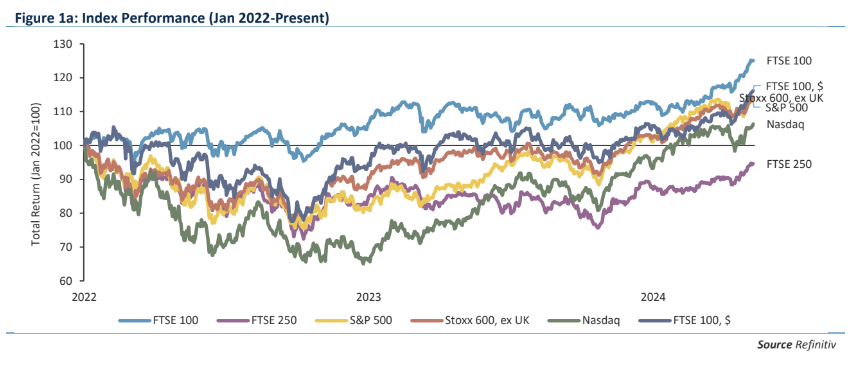

The FTSE 100 has emerged as the West’s best-performing major stock index in the era of higher interest rates following a massive rally that has narrowed the blue-chip’s discount to its international peers.

London’s premier index has produced a total return of 14.2 per cent since the end of 2021, when central banks across the world began to hike interest rates in an effort to tame runaway inflation.

Despite a challenging 2023, the FTSE 100 has taken off since last month and gained 9.4 per cent year-to-date on a total return basis on the back of an improving outlook for the domestic economy and optimism over near-term interest rate cuts.

The rally has seen the index set 12 all-time highs over the last month – a figure previously unheard of in the FTSE’s 40-year history.

Other global stock indexes are also rallying, with the US Federal Reserve and European Central Bank now expected to lower borrowing costs in the next few months as inflation falls to target.

But London remains on top. New York’s S&P 500 and tech-heavy Nasdaq 100 have rallied 11.4 per cent and 14.1 per cent respectively since the end of 2021.

Simon French, head of research at brokerage Panmure Gordon, pointed out in a note that the FTSE 100’s total returns during the period also beat both of these heavyweight indexes in dollar terms.

Meanwhile, Europe’s Stoxx 600 benchmark, excluding the UK is up 4.9 per cent since the rate hiking cycle began. With the UK included, this figure comes in at 7.8 per cent.

French said on Thursday that the FTSE 100’s recent gains had helped to narrow the discount of UK public companies to their international peers from 19 per cent in the final quarter of last year to 17 per cent now.

Analysts have blamed this remaining gulf for a wave of takeover deals sweeping through the UK’s public markets in recent months, many of which have originated from bigger US rivals pouncing on lower valuations.

“This UK discount – that has become self-reinforcing through falls in liquidity and relative performance – can unwind quickly given the procyclical nature of asset class performance but it will need UK policymakers to back up warm words with concrete actions,” French added.

“We remain adamant that the opportunity is real, broad-based across all sectors, amplified at the mid and small cap level – and recent public-to-private transactions have illustrated all these points. The opportunity for investors continues to hide in plain sight.”

Kellogg’s to cut hundreds of jobs as it announces closure of major factory

Hundreds of jobs are set to be axed after Kellogg’s confirmed plans to close its Manchester-based factory.

The company, which now goes by the corporate name Kellanova, first signalled its intention to make the move in February but stressed that no final decision had been made.

However in a statement, the business said it would now close its Trafford Park factory towards the end of 2026 with the loss of around 360 roles.

Kellogg’s plant “not viable”

UK managing director Chris Silcock said: “We want to acknowledge the professionalism of all colleagues at the factory during what we know have been some difficult discussions.

“When we announced our proposal earlier this year, we said it had nothing to do with the outstanding people who work at our factory.

“And, how everyone has chosen to conduct themselves over the last months has really brought this to life for us.

“However, we remain clear there isn’t a long-term future for the site.

“It’s laid out in a way that made sense in the 1930s, with food travelling up and down six floors in a legacy manufacturing process.

“What’s more, we only use half the space in the buildings and the investment required to maintain the factory in the coming years is simply not viable.

“We understand confirmation of something significant like a factory closure is never easy to hear and we will try to make it as smooth as possible.

“That means we’ll work with partners on things like outplacement support for our employees and, for the community, we will start to explore the long-term future of the site.”

The company’s Wrexham factories and MediaCity headquarters in Salford, which currently employ around 1,000 people, are not impacted by the news.

Greater Manchester will also remain the UK home of Kellanova.

A joint statement between Kellanova and the USDAW and Unite trade unions said: “Through collective consultation the company and employee representatives have agreed a substantial package which recognises our employees’ contribution to the Manchester plant and supports them to transition to life beyond Kellanova.”

Kingdom of the Planet of the Apes is a terrific summer blockbuster

Awkward titles, but great movies. Few reboots have got it as right as the 2010s Planet of The Apes trilogy. Rise of The Planet of The Apes (2011) introduced Andy Serkis’ Caesar, and through two sequels (2014’s Dawn… and 2017’s War…), we saw an action-packed journey that told a compelling story. Now, director Wes Ball (The Maze Runner trilogy) looks to continue that legacy. Kingdom of The Planet of The Apes is set 300 years after Caesar’s death in the last film. (In total there are now 10 movies in the franchise.)

Apes are dominant, while humans are scattered and considered feral. Young ape Noa’s (Owen Teague) peaceful life is disrupted when his tribe are abducted by Proximus Caesar (Kevin Durand), a brutish ape king with a twisted idea of Caesar’s legacy. Noa travels with an elder chimpanzee named Raya (Peter Macon) and a mysterious human name Mae (Freya Allen), both of whom challenge everything he thinks he knows as he journeys to rescue his family.

The thing that the Apes movies really nail is the way they can be enjoyed on several levels. There’s enough lore for you to connect the dots between films, but if you haven’t seen the Serkis movies this can be enjoyed as a straightforward action adventure. None of the exposition is hard to grasp, thanks mostly to Raka, and later human historian Threvathan (William H Macy) who fill in the gaps. The effects are beyond what even the first trilogy – which was no slouch – was capable of, taking motion capture performance to new heights. It’s tough to step into Serkis’ shoes, but Teague delivers a fine performance as a young ape becoming a leader. He shows what’s possible with the combination of technology and human performance.

If Kingdom doesn’t quite match the previous films, it’s only because they were magnificent. This new chapter is a terrific summer blockbuster, offering enough entertainment to suit casual crowds while also dropping enough information for those following the bigger picture. Few fourth instalments have felt this fresh.

Kingdom of the Planet of the Apes is in cinemas

Read more: Barbie, blockchain and the future of film financing

Read more: Made in England: The Films of Powell and Pressburger review