Omnicom and Publicis defend ad merger plan

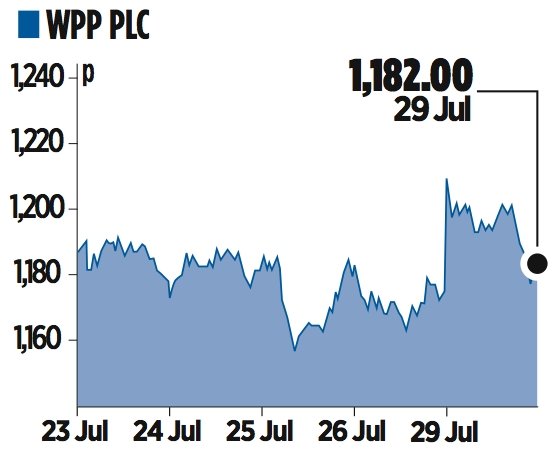

SHARES in Omnicom and Publicis rose in response to the advertising giants’ merger plans yesterday – but so did shares in rival WPP, on hopes that the London-listed company will benefit from client losses stemming from the landmark tie-up.

Publicis boss Maurice Levy insisted yesterday that the pair’s biggest clients support the deal. “Sure, there are some competitors which would have much liked to see us losing some accounts, as they will be extremely happy to benefit from this. I don’t believe it will be significant,” he said.

Omnicom’s John Wren said the “stars had aligned” for the merger of equals, which has been made possible by Publicis’ growth in recent years.

The firms expect to spend around $400m on integration, resulting in efficiency savings of more than $500m. Publicis Omnicom Group will have a market value of $35.1bn.

The pair do not intend to make any large disposals following the merger, and plan to maintain “the strictest of firewalls” to reassure competing clients on the enlarged company’s books, including Coca-Cola and Pepsi.

Rival firms are nevertheless waiting in the wings to take on customers dissatisfied with the tie-up.

“Most contracts have a change of ownership clause in them that allows a client to terminate for that reason alone,” Don Elgie of marketing specialist Creston told City A.M. “I would be amazed if there weren’t opportunities for us and other smaller groups.”