Ofgem considers halving price cap implementation period

Ofgem has revealed it could halve the implementation period for the price cap – cutting it down from two months to one month.

The measure would be part of announced plans to extend the monitoring period for assessing the price cap closer to the date it is meant to be updated.

Changes could be brought in place for the next update for the price cap in October – meaning the price could be announced in September rather than August.

Ofgem’s retail director Neil Lawrence said: “This is in line with our policy objective of shortening the period between price observation and delivery to reduce the volume risk faced by suppliers.”

He outlined that there was significant support from suppliers for a reduction in the notice period, even if “there are a number of practical issues to work through.”

If confirmed, the changes would mean the observation window would be from 1 March to 31 August for the winter period.

The energy regulator is continuing its efforts to reform the market, following the collapse of dozens of suppliers last winter.

Industry carnage has affected over four million customers – with suppliers crushed by the lethal combination of soaring gas prices and the price cap.

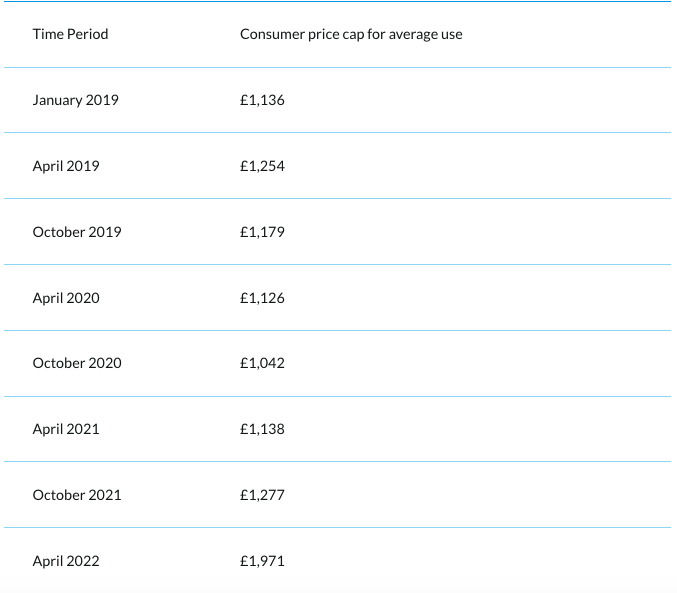

Analysts have warned the price cap could spike again this Autumn, with Investec, Goldman Sachs and Cornwall Insight have all forecasting that the cap could rise as high as £3,000 per year in October.

This follows an already established 54 per cent hike to nearly £2,000 per year from April – which caused Chancellor Rishi Sunak to roll out a £9bn rebate scheme for UK households to mitigate spiralling costs.

Earlier this month, wholesale prices spiked to an eye-watering £8 per therm, and remain elevated at £2.68.

For context, gas was priced at 44p per therm this time last year.

Ofgem has recently announced plans to bring in hedging controls and a fit and proper persons test for suppliers – to ensure firms are resilient to future market shocks.

It has also imposed a temporary levy on suppliers that take switching customers from other firms, to protect companies that hedged properly.