OEUK warns of overseas fossil fuel dependence as Norway becomes UK’s main gas supplier

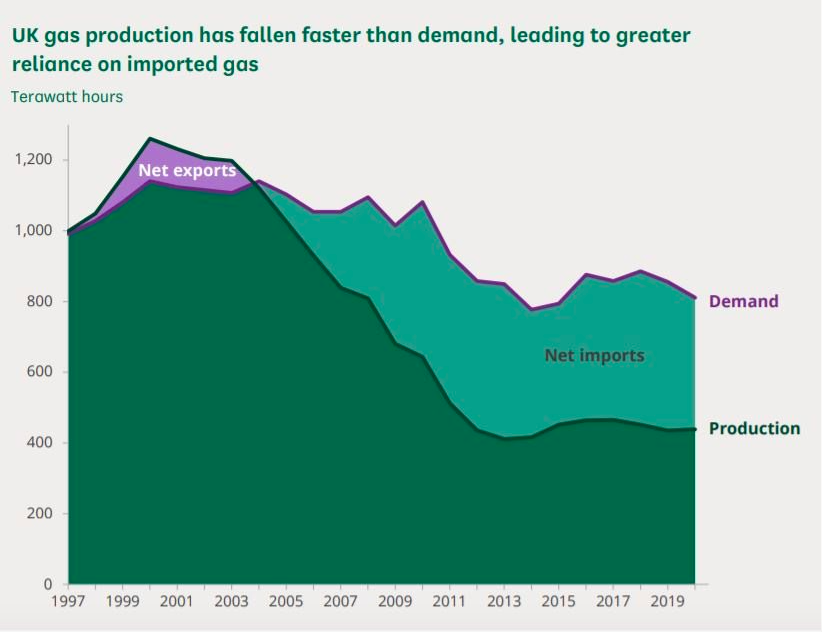

Industry body UK Offshore Energy UK (OEUK) has warned the country will have to import 80 per cent of gas supplies and 70 per cent of oil supplies from overseas without new investment in domestic fossil fuel projects.

Its freshly published Business Outlook suggested billions of pounds being needed to be invested in new North Sea exploration and production facilities, to prevent the country becoming dependent on external suppliers.

The report also revealed Norway has become the UK’s primary gas supplier, with new figures from the OEUK revealing the amount of gas consumed domestically from the country exceeded UK supplies for the first time last year.

Overall, the UK consumed 76bn cubic metres (bcm) – of which 32bcm were Norwegian and 29bcm were from the UK’s domestic continental shelf.

Industry body pushes for further North Sea investment

OEUK argues that while there are enough oil and gas reserves to support the UK for at least 15 years, there has been too little investment in the platforms, pipelines and infrastructure needed to access it.

It has revealed investment in the oil and gas sector has fallen from £16bn per year in 2014 to £5.5bn in 2019, predicting only £4bn of spending this year.

The group places the blame on the UK’s complex regulatory environment, alongside political disagreements around issues such as climate change and windfall taxes – which have deterred investment in the North Sea.

OEUK’s market intelligence manager Ross Dornan suggested oil and gas production will fall by up to 15 per cent a year unless there is rapid investment in new infrastructure.

He said: “The energy gap between what we produce ourselves and that which comes from other nations will keep growing unless we invest in exploration and production on the UK’s continental shelf. We must also accelerate the development of cleaner energy like hydrogen. Investment now will give us energy security in the years to come.”

Norway becomes the dominant player for UK consumers

While offshore wind has ramped up significantly, the OEUK fears the boost in developments is still to small to replace declines in oil and gas output from the North Sea.

Even though the government has pushed to ramp up renewables as part of its ten point energy plan and target to reach net zero carbon emissions by 2050, gas and oil supplied 75 per cent of the UK’s total energy in 2021, amid a generational underperformance in wind.

Gas is still the UK’s largest energy source, supplying 43 per cent of total UK energy last year, while oil is the second largest source – representing 32 per cent of total energy.

Despite its dominant position, the UK’s production of oil and gas fell sharply in 2021 – with a 17 per cent decline in 2020.

Oil production dipped to 45m tonnes, while gas production fell to 29bn cubic metres – while imports surged last year.

Imports made up 62 per cent of its gas supplies and 18 per cent of its oil, with OEUK expecting imports to rise continuously over the decade.

This means Norway’s newly found first-place status could be consolidated in the coming years without a significant boost in fossil fuel production.

Meanwhile, offshore wind, the most successful form of renewable energy to date, also requires significant investment if its expansion is to continue.

The OEUK report forecasts that the UK must invest £60bn in 3,000 new offshore wind turbines if it is to meet its target of quadrupling wind-powered electricity generation by 2030.

Deirdre Michie, chief executive of OEUK, said: “Last year OEUK signed the North Sea Transition Deal, a partnership with the UK government supporting the nation’s transition to a lower-carbon future and providing safe and secure energy throughout that transition. But that transition will only happen if our policymakers can create and sustain the right environment for long-term investment across all forms of energy production.”

The government is set to announce its energy security strategy over the coming days – which is likely to include pledges to boost nuclear, renewables and North Sea oil and gas exploration to ensure the country’s energy independence.

Business Secretary Kwasi Kwarteng has spoken in favour of boosting North Sea oil and gas in the House of Commons, while Shell is reportedly reconsidering its plans to ditch its Cambo oil plans.

Michie said: “Energy security is now a matter of national security. Our policymakers need to plan not just for the coming elections but the coming decades.”

The UK is currently enduring a widespread energy crisis – with wholesale prices spiking to £8 per therm earlier this month amid rebounding post-pandemic demand and fears of supply shortages following Russia’s invasion of Ukraine.

Meanwhile oil prices have soared above the $100 milestone in recent weeks – peaking on March 7 at $139 per barrel.

Analysts are now predicting the consumer price cap could rise to £3,000 per year in October, with Rishi Sunak reportedly considering further government schemes to help consumers despite already committing £9bn to a rebate scheme.