This is now a total employment recovery – and it brings Carney’s forward guidance into question

The most encouraging news in today's jobs data is the confirmation that the shift from part-time to full-time employment is in full swing.

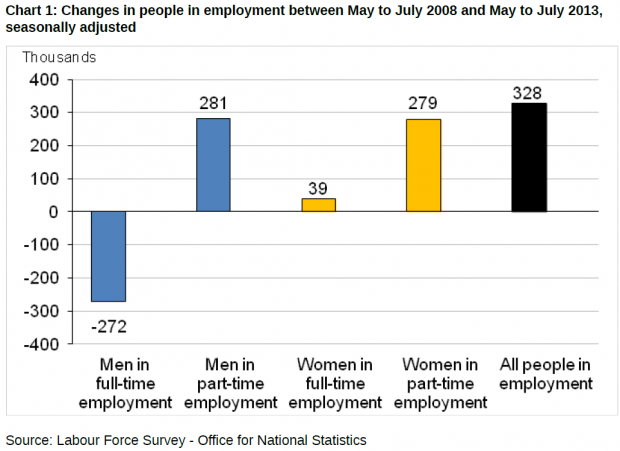

From the peak of the crisis, full-time employment numbers have been crushed, with part-time jobs filling the void.

Now we're seeing the pendulum swing back as the UK's economic recovery strengthens.

The number of men in full-time employment increased by 60,000 to reach 13.85 million.

The number of men in part-time employment fell by 19,000 to reach 2.10 million.

The number of women in full-time employment increased by 34,000 to reach 7.94 million.

The number of women in part-time employment increased by 5,000 to reach 5.95 million.

All good news, employment hours would seem to be going up, and while it's hard to estimate them that's what we should be concerned by, not the nominal number of jobs.

What all this illustrates is how bizarre it is to take each job as an equal unit of employment. But that's exactly what the Bank of England has done with its new unemployment threshold.

Many economists will suggest that Okun's observations may still hold – a rule of thumb that says for every one per cent rise in unemployment that GDP will be two per cent lower – but that is merely correlation analysis.

The pattern of work in the UK is shifting, and our flexible labour market sees many forms of employment arise, with workers hired on full-time, part-time and even zero hours contracts.

A product of both technological advances and lighter restrictions on the movement of workers that affect the nature of employment, Okun's "law" may no longer apply.

If unemployment continued to fall at today's rate, Bank of England governor Mark Carney would see his seven per cent unemployment threshold met in two years, not three.

Carney has left himself enough caveats to avoid a rate hike when that eventually happens, but markets are already pricing one in sooner than the Bank of England's forecasts suggest.

Alex Edwards, head of corporate desk at UKForex, said:

The fall in the rate is fuelling expectations that the central bank will hike the UK base rate sooner than the third quarter of 2016. The recent run of other positive UK data also supports this view, so all eyes will be on Carney when he speaks tomorrow. We think it’s going to be difficult for him to stick to his original guidance on monetary policy. A dovish steer becomes less likely, so there are more upside risks for GBP in the short term.