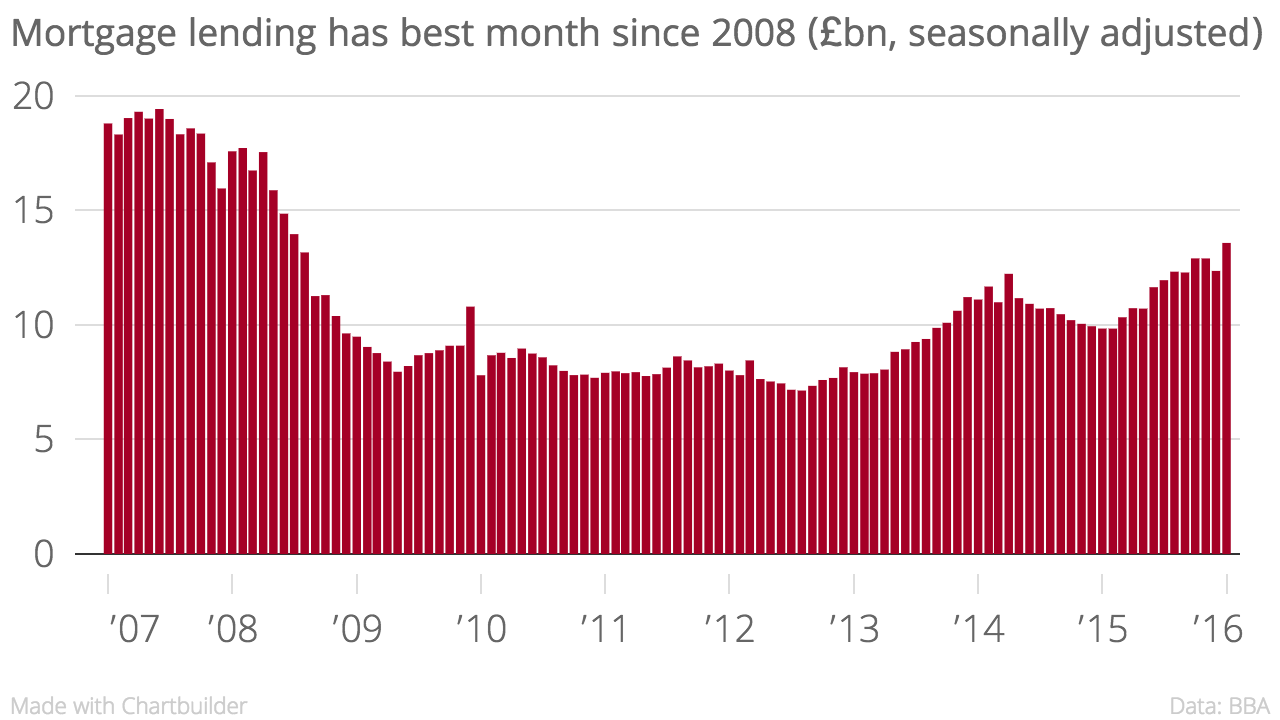

House prices to climb further as mortgage lending hits highest level since 2008 in January

Mortgage lending spiked in January, raising concerns that UK house prices could rise even faster.

Borrowing topped £13.6bn, 38 per cent higher than the same month last year and the highest since mid-2008, figures released this morning by the British Bankers' Association (BBA) show. The number of mortgage approvals was up 38 per cent on the year.

Companies borrowed an extra £3.4bn in January, up 1.5 per cent on last year.

"Consumer confidence is high, real income gains remain strong and mortgage rates are set to fall again in response to the decline in wholesale funding costs. New buyer enquiries at estate agents have been rising quickly and point to mortgage approvals rising by a further five per cent over the next three months. With the active supply of homes on the market close to record lows, house prices look set for very strong gains," said economist Samuel Tombs from Pantheon Macroeconomics.

“The start of the year has seen a significant rise in mortgage borrowing. It seems that this has been driven, in part, by borrowers looking to get ahead of the increases in stamp duty for buy-to-let and second home buyers scheduled to come into effect in April," said BBA chief economist Richard Woolhouse.

“Net lending to non-financial companies saw the biggest monthly jump since July 2008 as businesses take advantage of record low interest rates. Demand from the transport, storage and communication and construction sectors was particularly strong.”

Companies are preferring to raise cash by selling bonds and shares rather than taking out bank loans, the BBA said. They raised £23bn in the year to January through capital market finance.