Mortgage deals strike a four year high in August

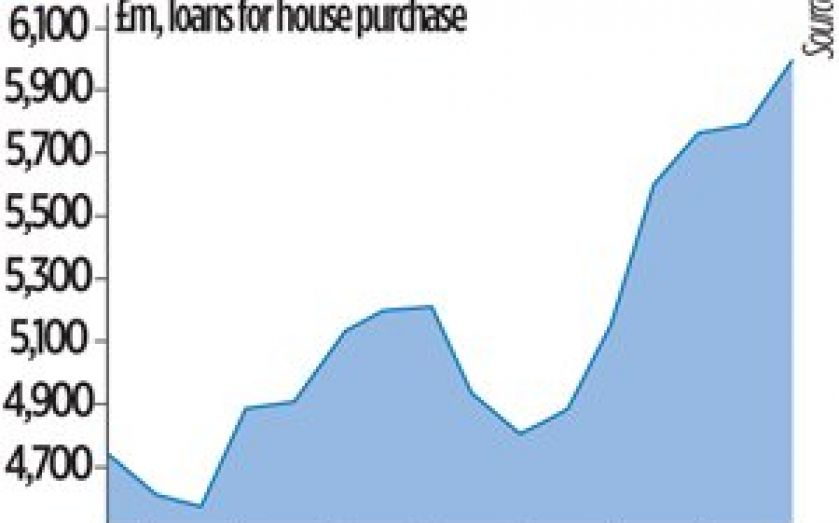

THE SURGING housing market has pushed mortgage lending to a four-year peak, according to the British Bankers’ Association (BBA), while lending to businesses remains anaemic.

The BBA said that last month its members approved 38,228 mortgages, an increase of just over 25 per cent from the same month last year, highlighting the recent boost to activity in the housing market.

However, while many economic indicators are pointing to the beginnings of a recovery, companies are still reluctant to borrow.

HMRC’s latest lending data confirmed the trend: residential property transactions have soared upward in the past 12 months, rising by 19.2 per cent, clearly showing the market acceleration since earlier in the year.

Despite the government’s Funding for Lending Scheme, which is intended to reduce rates and encourage lending, net borrowing by both financial non-financial businesses has dipped in the past six months.

Though there has been a drop in the amount of borrowing by businesses overall, the BBA reports that the amount extended to small and medium-sized firms has held stable.

Howard Archer, chief UK economist at IHS Global Insight said: “Stable lending to smaller and medium-sized companies in August may also be a sign that companies are starting to step up their borrowing as markedly improved economic activity in recent months lifts their confidence and need for capital.”

The BBA also reports that there has been a rise in unsecured consumer credit, for the fourth month in five.

Archer added: “It is likely that markedly improving consumer confidence means that people have become more prepared to borrow in recent months. It may also be that the squeeze on consumer spending coming from inflation running well above earnings growth means that some people are having to borrow more to finance any major spending.”