Mortgage approvals for first-time buyers rise as UK house price growth slows

Mortgage lending is still being dominated by customers looking to buy houses rather than remortgage, and first-time buyers are on the up.

According to the Council of Mortgage Lenders (CML) total gross lending for June was up six per cent on May and 20 per cent up on June 2013, totalling £17.9bn.

£4.2bn of that was paid out in loans to first-time buyers; a figure seven per cent higher than the previous month and 19 per cent up on June 2013.

Overall, £5.9bn was loaned to home movers, a four per cent monthly- and 11 per cent annual – increase.

Despite a slowing of house price rises, the increases show continuing demand in the market, which could be affected by the impending Bank of England interest rate hike.

Richard Sexton, director of e.surv chartered surveyors, commented:

Steadily growing first-time buyer demand is bolstering the housing market and lifting lending levels. Interest rates remain low, allowing first-timers to enjoy cheaper repayments and lock into affordable fixed-rate deals. And banks are offering a larger array of deals to support borrowers struggling to put together a large deposit to get onto the housing ladder.

One in five home loans were to high loan-to-value borrowers in June, compared to one in nine twelve months before, as the first-time buyer effect grows in strength.

First-time buyers seem to be willing to fork out slightly more of their earnings too, with the loan-to-income ratio continuing to climb. In June the rate had crept up to 3.47 times annual salary, from 3.46 in May.

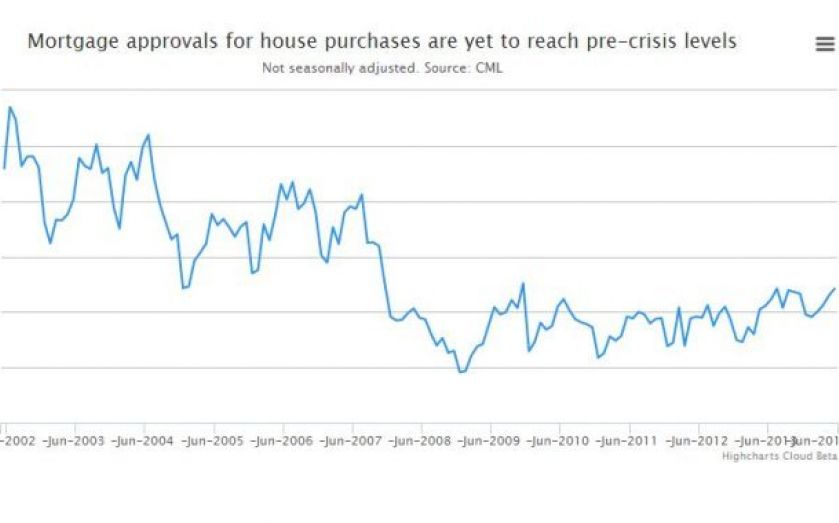

Although house prices have been soaring recently, demand has not not seen mortgage approval numbers return to the heights the market was accustomed to pre-crisis.