Lower inflation could carry on falling this year

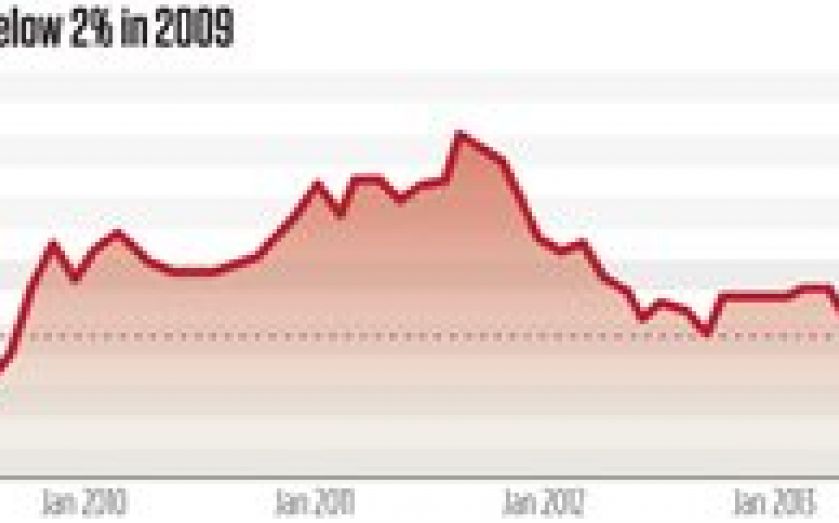

INFLATION fell below the Bank of England’s target in January, according to figures released yesterday, as the consumer price index grew by only 1.9 per cent in January.

Though inflation has not been below two per cent since November 2009, some analysts are now projecting that it will continue to fall through the year. Capital Economics is projecting that CPI could drop as low as one per cent later in 2014.

“This should enable real pay to rise for the first year since 2007 and allow the monetary policy committee to keep interest rates on hold until late 2015,” said Samuel Tombs, the group’s UK economist.

Above-target inflation has been part of the pressure on UK living standards, and lower rates of CPI would make real wage increases more likely. Many analysts have suggested that with ongoing economic growth, the first average real wage increases since the recession are likely to be recorded this year.

“In the short-run, it is possible that inflation could creep down further. The recent impact of sterling appreciation is likely to result in further moderation of prices. There may also be some further softness in international food prices feeding through to domestic prices,” added Colin Bermingham of BNP Paribas, agreeing that inflation could continue to drop this year.

Core CPI, which measures price increases without volatile items like energy, food and alcoholic drinks, dropped to only 1.6 per cent in January. Energy prices rose at a slower pace, up 6.6 per cent. As recently as August, energy prices rose by 7.8 per cent in the previous 12 month period.

The retail price index (RPI) hit 2.8 per cent last month, well above CPI. RPI was previously used as the official level of inflation.