Legal bills drag down Deutsche Bank’s earnings

GERMAN lender Deutsche Bank saw profits plunge on soaring litigation fees in the second quarter, the institution announced yesterday, while it had to announce further cuts to operations to hit new regulatory capital targets.

Net income fell 50 per cent to €335m (£291.5m), despite net revenues rising two per cent to €8.2bn.

Corporate banking and securities drove much of that improvement with revenues up nine per cent to €3.7bn, while global transaction banking revenue edged up one per cent to €994m.

Asset and wealth management revenues also rose six per cent to €1bn.

But credit losses increased 13 per cent to €473m and the bank set aside an extra €630m to cover litigation costs.

The bank cited Libor and other related interbank interest rates as one area where litigation is ongoing. Regulators across the world have requested information from the bank as part of their investigations into the benchmarks.

Customers and clients who claim to have lost money from the manipulation of Libor and other rates have launched legal actions.

It is also involved in investigations into the sale of mortgage and other asset backed securities in the boom years before the financial crisis.

“We took an important step toward our objective of placing Deutsche Bank at the forefront of cultural change with the launch of our new values,” said co-chiefs Jurgen Fitschen and Anshu Jain. “In the months ahead we will work on embedding these values.”

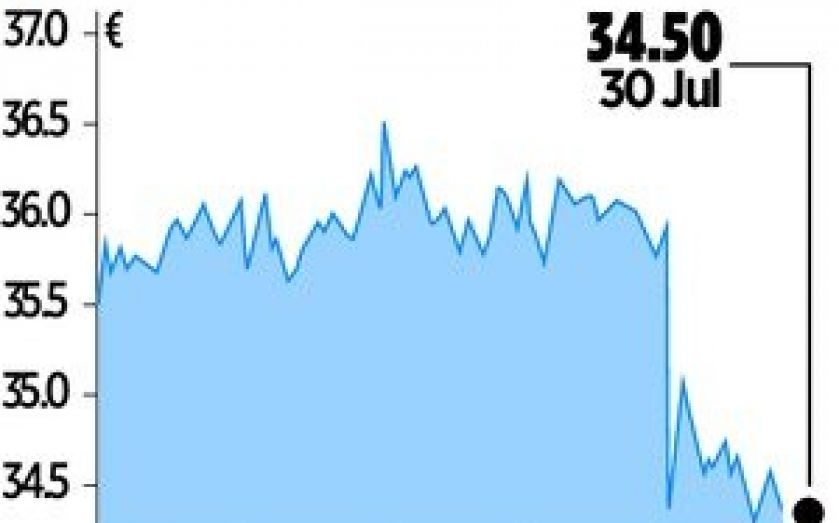

Return on average shareholders’ equity came in at 5.6 per cent, down from 6.8 per cent a year earlier. Deutsche Bank’s shares fell 4.86 per cent.