Julius Baer hits asset high amid Israeli takeover

WEALTH manager Julius Baer yesterday said it would acquire the private banking assets of Israeli lender Bank Leumi as it unveiled a strong set of half-year results.

The Swiss-based group, which offers services for well-heeled savers, will take on Bank Leumi’s SFr5.9bn (£3.8bn) of assets in Switzerland and a private bank subsidiary in Luxembourg with SFr1.3bn of funds. The group will pay SFr10m to acquire the accounts.

Under the deal, Leumi will also refer high net worth individuals to Julius Baer, while Baer will refer customers in need of domestic banking in Israel to Leumi. The deal came as Julius Baer said assets under management had risen to a record high of SFr274bn at the end of June, eight per cent higher than six months ago.

The rise was driven by SFr7.5bn of new cash attracted from customers while an additional SFr 6bn was added through its acquisition of Brazilian fund manager GPS.

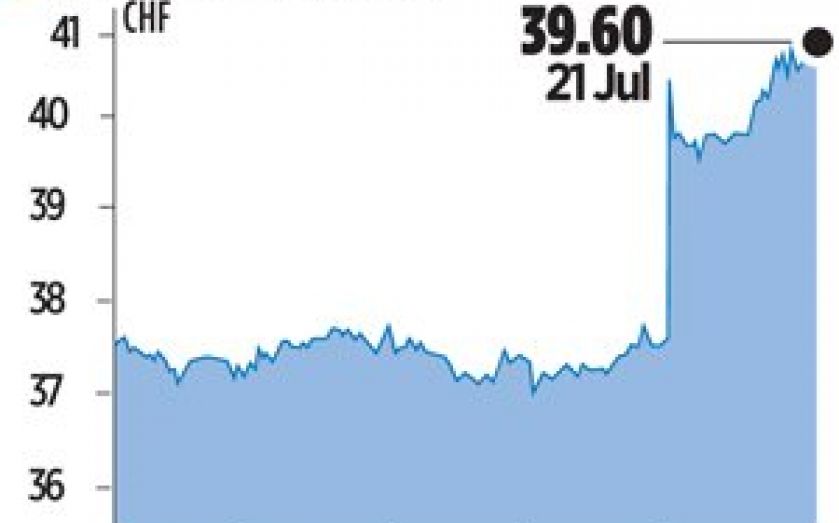

“We are very pleased with the strong financial performance in the first half of 2014. The substantial further asset growth of the group and the excellent net new money result led to an all-time high in assets under management,” Julius Baer boss Boris Collardi said. Shares closed up 8.34 per cent.