Is oil’s relationship with energy stocks slipping?

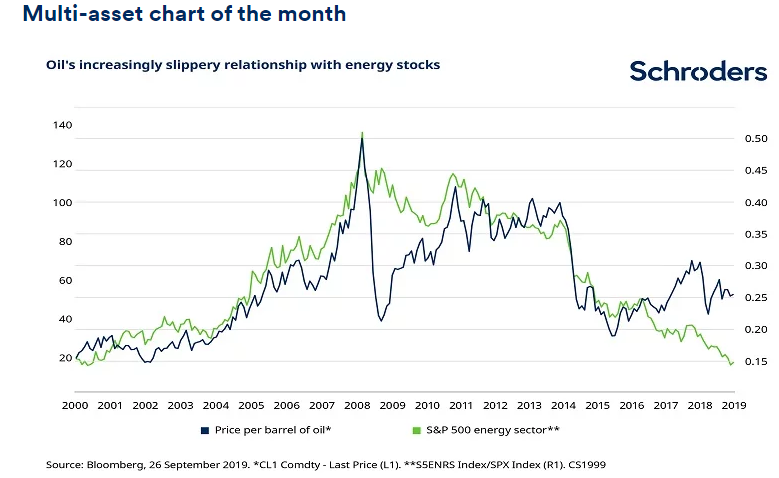

Our chart of the month shows that the link between energy stocks and oil appears to be on the slide. What’s happening?

Typically, the US energy sector trades in tandem with oil prices. The sector is largely made up of household names like Exxon and Chevron, involved in exploration and production. They are known as “upstream” producers. These companies’ profit margins are closely tied to the price of oil, so we expect the markets to speak to each other.

However, over the last three years we have witnessed a breakdown in this relationship. In the time since it bottomed in the first quarter of 2016, oil has gained $21/barrel, but energy stocks have underperformed the main US stock market index, the S&P 500, by 12% per annum.

There is a clear disconnect, and this widening gap shown in the chart below has caught the eye of the multi-asset investment team this month.

Past performance is not a guide to future performance and may not be repeated.

The energy sector’s underperformance versus oil suggests there could be the potential for it to ‘catch-up’ in the future, although this is by no means guaranteed. Could such a trade be too good to be true?

What is happening?

As a commodity, the price of oil is primarily driven by supply and demand. Concerns about sluggish global growth and oversupply have been met with worrying headlines, particularly regarding Iran sanctions and Middle East tensions. Together they’ve swung oil prices — most recently into positive territory. Yet shares in the energy sector continue to underperform.

Unlike in the past, energy stocks are gaining less when oil goes up than they are falling when the oil price goes down. Simply put, the stock market does not appear to believe in the sustainability of oil prices.

This anomaly has notably played out over the past several months. In May and June this year, five oil tankers were attacked in the Gulf of Oman. As a sudden negative shock to oil supply, this should have been a boost to the price of oil and energy stocks, but the latter underperformed the US market by 3 per cent.

Then again in September we saw tensions flare up further with a surprise drone attack on Saudi Arabia’s main oil processing plant.

Energy stocks reacted strongly, but there was no sustained rally; within weeks the sector retreated below pre-attack levels.

For more read and watch:

– Is Bill Gates right about the “zero” climate impact of fossil fuel divestment?

– What does disruption mean for investors?

– Could WeWork disrupt offices like Amazon disrupted shopping?

What are the repercussions?

The energy sector is now trading at a record cheap valuation. One measure of valuation is the price- to-book ratio. This is calculated by dividing a company’s stock price by its book value per share, which is defined as its total assets minus any liabilities.

Currently the price to book ratio of the energy sector as a whole is in the bottom one percentile of its 30-year history.

However, companies’ earnings are weak and year-on-year growth is poor, which justify these almost rock-bottom valuations. The chances of an improvement to earnings don’t look promising, and investors want to pay for earnings that are predictably good.

This means that the market sentiment for energy stocks has turned decidedly negative with more money leaving the sector than being invested into it year-to-date. And though the energy sector was once 10 per cent of the S&P 500 as recently as 2013, the sector now represents less than 5 per cent. Energy is close to being forgotten, and even a turn in performance may not be enough to tempt investors back into this tiny corner of the market.

How do we interpret it?

Energy requires a strong upturn in the economic cycle to outperform. The ongoing trade war is having a meaningful impact on global demand while on the supply side, this year’s geopolitical risks have mostly been isolated to the Middle East. They are therefore unlikely to have a meaningful or lasting impact on global activity.

Ongoing US-China trade tensions further explain equity investors’ pessimistic outlook. Currently the market is weighing headwinds from trade tensions, recession signals from the US yield curve, and potential disruption in the euro area because of a disorderly Brexit. Altogether this acts as a drag on global growth, and therefore demand.

The sector faces serious headwinds from the transition towards next-generation energy solutions. The cost of renewable sources is expected to decline driven by economies of scale and improving technology, which will create competitive pressure.

How are we positioned?

The multi-asset team at Schroders is currently neutral on energy stocks. We acknowledge that valuations are compelling but believe the sector lacks the catalysts for a sustained upswing in performance. Energy cannot deliver that until we see a turn in the cyclical data.

At the moment we can afford to be patient, but energy could be a good opportunity when the data turns.

For more views from Schroders visit their insights hub and follow them on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.