Investors lap up Bankia’s debt as Spanish lender returns to market

BANKIA paid less than initially planned for its five-year bond issued yesterday, as investors were unexpectedly keen for the debt.

The lender raised €1bn (£825m) in the issuance, paying 235 basis points over mid-swaps.

That represents a discount relative to the expected cost of mid-swaps plus 250 basis points, as the issue was oversubscribed.

The healthy interest in the bond represents something of a turnaround for the bank which suffered badly in Spain’s housing crash and subsequent deep-hitting economic recession.

Last year Bankia reported a loss of €24bn as it set aside more money for property losses in an effort to draw a line under its problems.

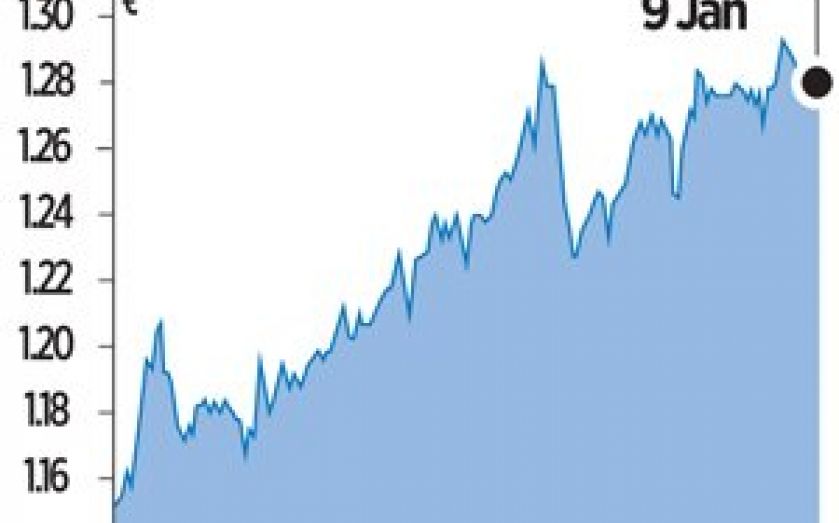

The successful bond issue should give the lender a boost – its shares rose 1.35 per cent yesterday.